What is a bond yield?

You might have already heard about investing in bonds, a form of investing dating back centuries. But what are bond yields exactly, and how do bond yields work?

In this article, we answer some of the key questions to help you better understand how the return on bonds works, including the formula to calculate a bond yield, its relationship to bond prices, and what influences it.

Bond yields explained: Bond yield measures the return on a bond, reflecting annual interest as a percentage of its current market price

Bond yield vs. price: Bond yields and prices move in opposite directions - when bond prices rise, yields fall, and vice versa

Types of yields: Current yield measures return based on the bond’s price, while yield to maturity (YTM) provides a comprehensive evaluation of returns over the bond’s entire life

What are bond yields, and how do they work?

Bonds are loans that investors provide to governments, companies, or organisations to raise funds for various projects. When you invest in a bond, you’re lending money to the issuer in return for regular interest payments, known as coupons, over a set period. In the UK, these bonds are called gilts, while in the US, they are known as treasuries. Bonds issued by companies are referred to as corporate bonds.

So, what is a bond yield? A bond yield, sometimes called “interest yield”, represents the return an investor earns from a bond, expressed as a percentage of its current market price. We say “current”, because a bond can be bought and sold in the financial market, which means its price fluctuates based on interest rates, inflation, and the issuer’s creditworthiness. You can think of the bond yield as an investor’s reward for lending their money to the government or a company by buying bonds.

Because the bond market in the UK is so vast, valuing nearly £2.4 trillion as of June 2023, the yield can be useful to compare the attractiveness of potential bond investments. Higher bond yields typically suggest higher perceived risk, while lower yields may suggest a safer investment. For corporate bonds, weighing up the bond yield alongside things like cash flow and liquidity can help investors to decide where to put their capital.

What are the types of bond yields?

When evaluating bonds, you’ll come across different types of bond yields. The two most important ones to understand are:

- Current yield: The current yield shows the annual return an investor can expect based on the bond’s current market price. It’s calculated by dividing the bond’s annual interest payment (coupon) by its current price. The current yield doesn’t consider factors like the bond’s maturity value or payment frequency. As such, it tends to be used to evaluate bonds that might be sold before they mature.

- Yield to maturity (YTM): Yield to maturity provides a more complete picture of a bond’s return. It represents the total expected return if an investor holds the bond until it matures. YTM takes into account the bond’s current market price, all interest payments (coupons), and any capital gain or loss if an investor bought the bond at a price different from its face value.

As with any investment, investors will be looking at risk and return. Both measures can help investors compare bonds. For example, bonds with higher current yields might provide more immediate income but could be less profitable in the long term compared to bonds with higher YTMs. Bonds with lower current yields might offer higher YTMs if they are expected to provide significant capital gains by the time they mature.

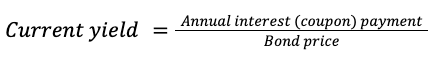

What is the bond yield formula?

The current yield has a fairly easy equation: simply divide the bond’s annual interest payment by its current market price.

For example, if a bond pays £50 in interest each year and its current market price is £1,000, the current yield is 5% (because £50 divided by £1,000 equals 0.05, or 5%).

For yield to maturity (YTM), the calculation is slightly more complex, as it also takes into account any gain or loss based on the bond’s purchase price compared to its face value. Because of this complexity, it can help to use a financial calculator or an online bond yield calculator. Just enter details like the bond’s price, face value, purchase date, maturity date, coupon rate, and payment frequency, and the calculator will work out the yield for you.

The information provided here is for informational and educational purposes only and does not constitute financial advice. Please consult with a licensed financial adviser or professional before making any financial decisions. Your financial situation is unique, and the information provided may not be suitable for your specific circumstances. We are not liable for any financial decisions or actions you take based on this information.

Is a bond yield the same as the interest rate?

The interest rate, or coupon yield, forms part of the bond yield, but the two are not quite the same. The coupon yield is the fixed annual rate of interest paid by the bond when it is issued, which doesn't change over the bond’s lifespan. In contrast, the bond yield represents the overall return you earn from a bond, including both the interest payments and any changes in the bond’s price.

And as we’ve seen, the most basic bond yield - the current yield - is calculated by dividing the bond’s annual interest payment by its current market price. Even though the coupon yield remains the same, if the bond’s market price fluctuates, the current yield will also fluctuate.

If you prefer predictable returns, fixed rate bonds can offer an alternative. Their interest rate doesn’t change over the term, so you know what you’ll earn regardless of market fluctuations.

What is the yield of a bond in relation to its price?

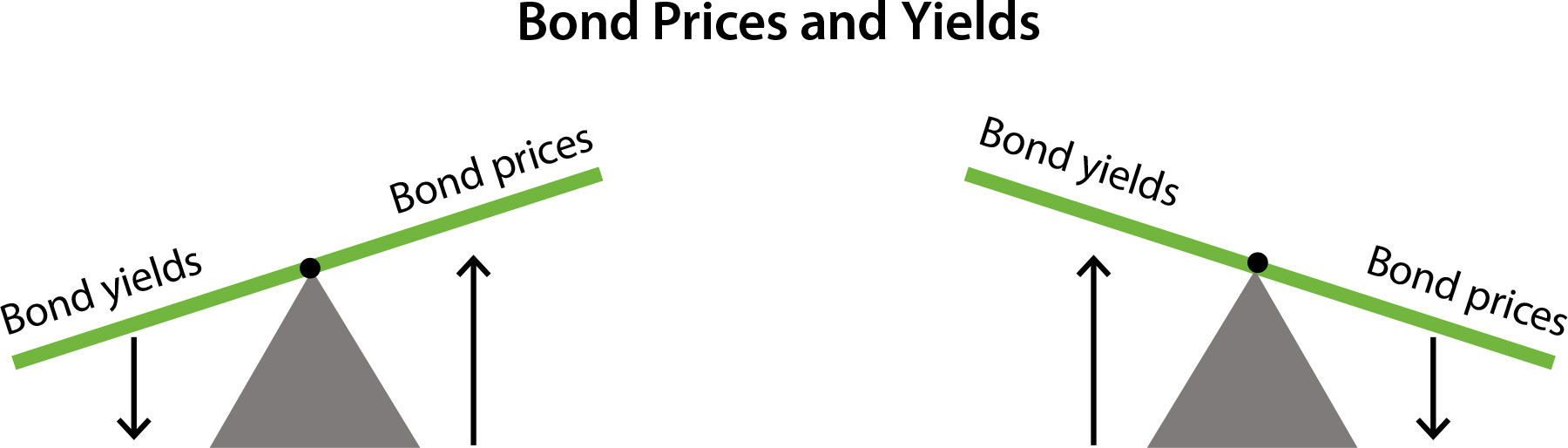

Bond prices and yields move in opposite directions, a bit like a see-saw.

Source: https://www.rba.gov.au/education/resources/explainers/bonds-and-the-yield-curve.html

The key thing to remember is: when the price of a bond goes up, its yield goes down. This happens because a higher bond price means new investors pay more to buy the bond, making the yield, or the return on their investment, smaller. And vice versa: when a bond’s price drops, its yield increases because investors can get the same fixed interest payments for a lower price.

For example, imagine you buy a bond with a face value of £1,000 that pays £50 in interest each year. If you purchase this bond for £1,200, your yield is 4.17% (£50 divided by £1,200). However, if the bond’s price drops to £800, your yield increases to 6.25% (£50 divided by £800). The annual interest payment stays the same, but the yield changes because the bond’s price has fallen.

This relationship affects how bonds are valued in the market. Investors receive interest over the life of the bond and get its face value when it matures. If a bond is priced below its face value (trading at a discount, or below par), its yield is higher than the original coupon rate. On the other hand, if a bond is priced above its face value (trading at a premium, or above par), its yield is lower than the coupon rate.

How is a bond yield paid?

Bond yields are paid to investors in two main ways: through regular interest payments, and what’s known as the return of principal at maturity.

Firstly, bonds typically pay periodic interest payments (coupons) to investors. These payments are usually made semi-annually or annually, depending on the bond’s terms. The amount of each coupon payment is determined by the bond’s coupon rate, which is a fixed percentage of the bond’s face value.

Secondly, at the bond’s maturity date, when the bond expires, the issuer repays the bond’s face value (also known as its principal) to the bondholders. Bond maturity dates typically range from five to 30 years, although there have been cases of government bonds being released with a maturity of 55 years.

This structure allows investors to earn income from bonds over time while also eventually receiving their initial investment back.

What factors affect bond yields?

Economic factors tend to play a big role in the development of bond yields. There are several factors involved, including:

- Interest rates: Changes in the Bank of England’s interest rates directly affect bond yields. When the Bank raises rates, new bonds offer higher yields, causing existing bond yields to rise as well. When rates drop, bond yields generally fall.

- Inflation: Higher inflation often leads to higher bond yields. When inflation rises, the real value of bond payments decreases, so investors demand higher yields to compensate for this loss.

- Yield curve: The yield curve, which plots yields of bonds with varying maturities, reflects investor sentiment about future economic conditions. A steep yield curve typically indicates anticipated higher future yields.

- Credit rating: When it comes to corporate bonds, a company’s credit rating reflects its ability to repay debt. Higher credit ratings generally lead to lower yields because they indicate lower risk, while lower ratings result in higher yields due to increased risk.

- Bond supply and demand: If there is a large supply of bonds (for instance, if the government or a company is issuing many bonds), yields might increase to attract buyers.

What happens when bond yields rise and fall?

When bond yields rise, it typically means that investors are less interested in holding that particular bond.

What you’ll often see is bond yields rising when market interest rates increase. New bonds then offer higher interest rates, making existing bonds with lower rates less attractive. As a result, the prices of these existing bonds drop, leading to higher yields. And the same applies vice versa.

When interest rates remain stable, like the 4.75% rate maintained by the Bank of England in December 2024, it means that there are no immediate changes to borrowing costs. This can provide some degree of stability for investors, whether they have existing bonds or are looking to buy some.

Using the bond yield to understand risk

With high-yield corporate bonds in particular, there’s always a chance the issuing company might not be able to repay the loan or make interest payments. If a company defaults, investors could lose some or all of their investment.

If you’re looking for alternatives to bonds, here are some options to consider:

- Real Estate Investment Trusts (REITs): REITs are often touted as an alternative to bonds. They allow investors to own shares in real estate portfolios, providing potential dividends and capital appreciation.

- Stocks: Investing in stocks can provide regular income through dividends. Unlike bonds, where you get your investment paid back at maturity, stockholders own a part of the company and potentially benefit from how well it performs.

- High-yield savings accounts: Although they can’t compare to the potential returns from investing, a high-interest account can be a more secure alternative. Deposits you make are typically protected up to a certain amount by the Financial Services Compensation Scheme (FSCS).

- Fixed rate bonds: Fixed rate bonds usually offer competitive interest rates in return for locking your money away for a set time. They can provide stability and security for investors who prefer a consistent income.

Explore other ways to grow your money

Investing comes with many risks. If you’re looking for more predictable returns, you might consider opening a savings account. Our fixed rate bonds offer competitive rates from the moment you open the account until the end of the term. These accounts provide a more predictable alternative to investing in bonds. Register for free with Raisin UK now to get access to the top rates.