4.50%

AER

Fixed rate bond

United Kingdom

(AA)

The benefits of multiple savings accounts and how to manage them

There’s no set limit to how many savings accounts you can have in the UK; it ultimately comes down to how comfortable you are with managing them, as well as the deposit protection limit. On this page, we take a look at what to consider when having multiple savings accounts, which accounts you might choose, the pros and cons, and ways to make managing them a bit easier.

Can you have multiple savings accounts?: You can have as many savings accounts as you like, but you’ll need to make sure you can manage them comfortably

Advantages: With multiple savings accounts, you can separate your savings goals and take advantage of better interest rates

Managing multiple accounts: The FSCS protects deposits of up to £85,000 per person, per financial institution, so opening multiple savings accounts can ensure every penny is covered

Many people stick with the one savings account, and there’s nothing wrong with that. You’re still saving something and ideally making some money on your savings. And with just one account to look after, it can make life easier. But can you have more than one savings account? The answer is yes. As long as the terms and conditions allow for it, there’s nothing to stop you having more than one savings account. And you can often have multiple accounts with the same financial institution.

Here are some examples of situations when you might consider opening multiple savings accounts:

You have several different savings goals, and you want to keep your money for each goal separate. Separate accounts for each goal prevents savings becoming muddled, and allows you to more easily track how much progress you’re making towards each one.

Your savings goals have different timelines. For example, shorter-term goals, such as saving for a summer holiday, would probably suit a different savings account to saving for retirement.

You want to take advantage of a new customer bonus or more generous account terms offered by another bank or building society.

You’ve built up a pot of savings that exceeds the limit for deposit protection under the Financial Services Compensation Scheme (FSCS). Opening a savings account with another financial institution can ensure you’re still covered.

When considering, “how many savings accounts should I have?”, you don’t always need a separate account for every savings goal. Some banks, particularly the newer digital banks, offer the option of categorising your savings within a single account. That way, you can clearly see how much you’ve saved for each target. You could also use a money-saving app linked to your account that can help you put your money towards specific goals.

If these options aren’t available to you, having multiple savings accounts can help you keep your goals organised. Let’s say your goal is to set up an emergency fund. If your fund is mixed up with other savings, it can get confusing. Having that separation creates a psychological barrier, where you’re less likely to touch any funds meant for emergencies.

Because savings accounts vary widely in terms of their features, different goals will also suit different accounts. For an emergency fund, easy access will likely be most important, whereas if you’re saving for a mortgage deposit, a high-yield savings account where you lock your funds away could help you reach your target more quickly.

Having said that, if you’re disciplined with your savings and generally happy with your current savings account’s services and interest rate, working towards multiple goals within a single account might work just as well for you.

The information provided here is for informational and educational purposes only and does not constitute financial advice. Please consult with a licensed financial adviser or professional before making any financial decisions. Your financial situation is unique, and the information provided may not be suitable for your specific circumstances. We are not liable for any financial decisions or actions you take based on this information.

Having multiple savings accounts on the go is not without its downsides. Opening and managing several accounts can be time-consuming, and what you actually want to get from your savings accounts can become neglected in the process.

Here are some drawbacks to be aware of:

You’ll need to remember multiple logins, passwords, and security questions. Plus, if you opt for multiple types of savings accounts, it can be hard to keep track of your obligations as a saver. To give an example, regular savings accounts require a specific amount of money to be deposited each month. Missing a deposit can land you with a penalty or a lower rate.

Chasing the best new customer bonuses or transferring amounts between accounts as soon as interest rates go up can be more effort than it’s worth. It’s easy to get distracted by tempting offers and lose sight of your savings goals.

You could end up with an account with an attractive rate that falls considerably after the first year, or as soon as you start withdrawing your money.

Keeping all your money in a long-term account such as a fixed rate bond can sometimes earn you more interest than spreading it across multiple accounts. That’s because you can lock in a favourable rate for a set period and benefit from a guaranteed amount of interest when the term is up.

If you have a large amount of money to save, and you open several savings accounts with the same bank, there’s a chance you’ll exceed the FSCS protection limit. That’s because FSCS deposit protection is per financial institution, not per account.

In some cases, you might prefer to consider multiple current accounts instead. This would suit people who want to separate different forms of income and expenses, such as direct debits, salary payments, and joint accounts.

Savings accounts vary widely in terms of minimum deposit, withdrawals, duration, and how interest is calculated. If you have a lump sum of money, your requirements will likely be different to someone starting their savings journey from zero. Also keep in mind that some account providers require you to be an existing customer to qualify.

When choosing a savings account, you might think about what you’re saving for and how soon you’ll need access to your money. Here are a few different types of accounts to suit different goals:

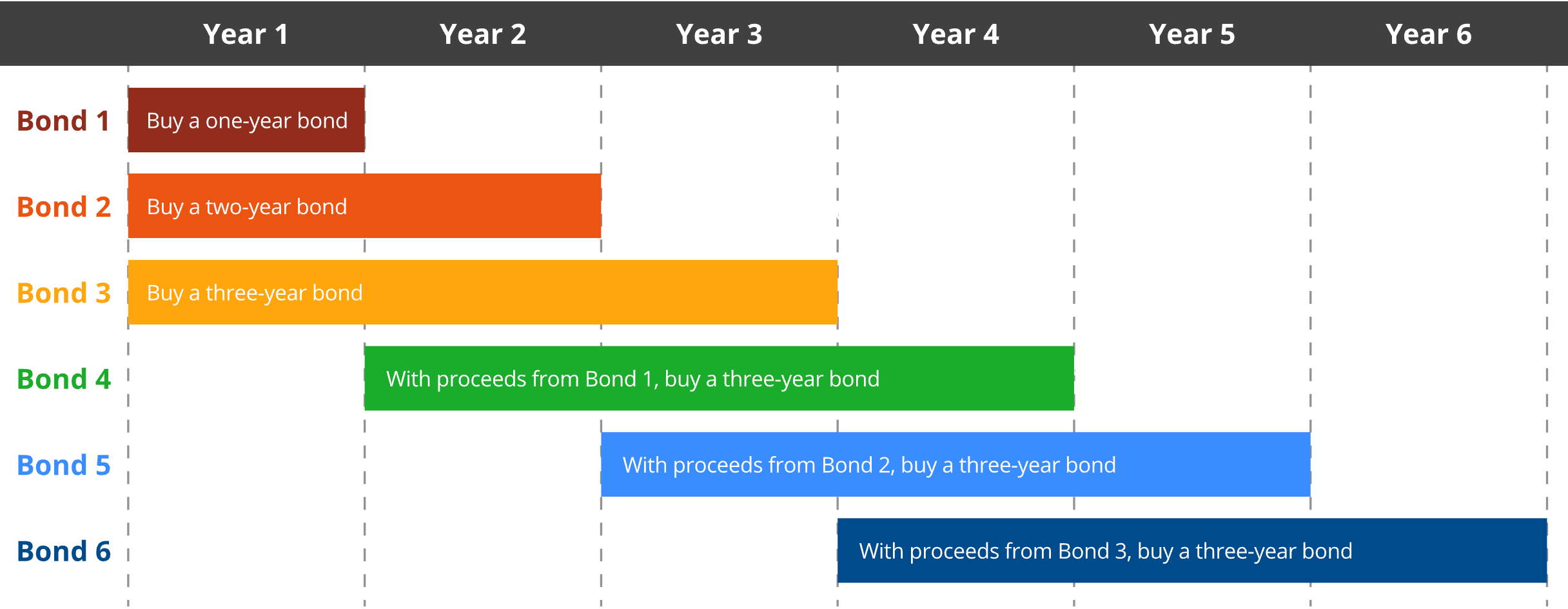

If you’re still wondering, “how many savings accounts should I have?” and you have a lump sum of money to save, laddering fixed rate bonds could be your answer. Here, you split your money across bonds with different terms and interest rates.

When the shortest bond matures, you can reinvest the money into a new longer-term bond with a higher rate. As time goes on, you build a “ladder” of bonds, giving you regular access to some funds while ideally earning better returns on the longer-term ones.

In the example below, you start by opening three fixed rate bonds, gradually reinvesting the funds in three more accounts as they mature:

The priority for many savers is to get a good interest rate on their savings, so it’s important to shop around. Comparing savings accounts using an online portal can help you secure higher rates than you’d typically find on the high street.

Try to avoid opening more savings accounts than you need. You could work out how roughly much money you expect to save. Remember, the FSCS protects deposits up to £85,000, per person, per financial institution. Spreading larger amounts across different banks and building societies is one way of making sure all your savings are fully protected.

To make managing accounts easier, you might consider automating transfers from your current account. This helps you save regularly without thinking about it. Budgeting can also help you set aside a fixed amount of your income each month toward your goals.

Raisin UK makes it easy to manage multiple savings accounts. Our free, no-fees marketplace lets you compare and open savings accounts from a range of banks and building societies, all in one place. With competitive interest rates and clear details like term lengths, you can choose the right accounts for you with just a few clicks, and there’s no need to fill out any extra forms. Register today to access top savings accounts, or find out more about opening savings accounts with Raisin UK.

If you’re wondering, “how many savings accounts can I have” for tax purposes, you might be concerned about growing your savings so much that you end up having to pay tax on them.

Savers in the UK can earn a certain amount of interest before paying tax, thanks to the personal savings allowance. If you’re a basic-rate taxpayer, you can earn up to £1,000 in interest tax-free (as of 2025). Higher-rate taxpayers can earn up to £500, while additional-rate taxpayers don’t get this allowance.

Of course, you might be thinking of opening multiple individual savings accounts (ISAs) to avoid tax entirely. You are free to hold more than one ISA, but keep in mind that you can only deposit money into one type of ISA per year, and you are limited to depositing up to £20,000 per year across your ISAs.

While having at least one savings account is the general recommendation, having two or more can help you meet different goals. Raisin UK makes it easy to manage multiple savings accounts from a single login. Once your Raisin UK Account is set up and approved, you can deposit your funds and start opening savings accounts. And we have a free app, so you can manage your money on the go and are always informed of the latest rate increases.

What’s in it for me?