How to save for a wedding

Home › Savings › How to save › Saving for a wedding

Planning the perfect wedding involves more than just picking the right flowers and venue – it can help to consider your overall financial situation. Understanding wedding costs and how to save for a wedding in the UK can help shape your plans for your special day. In this guide, you’ll find out how much you might need to save for your wedding, and get tips to help you save more effectively. We also share ideas for planning a wedding on a budget and explore different types of wedding savings accounts.

Wedding costs: The average cost of a wedding varies considerably depending on what you want from your day, where you live, and the type of wedding you’re planning.

Wedding budget: A lot of couples budget too little for their wedding or have already spent more than initially planned. Avoid this by realistically calculating your wedding expenses.

Wedding savings accounts: If you open a dedicated wedding savings account, it might be worth choosing one that offers flexibility so you can easily access your money if you need to pay for something urgently.

How much do I need to save for a wedding?

The total amount you need to save for your wedding will vary depending on factors like size, location, and individual preferences. It might also be useful to consider: how much does the average wedding cost in the UK? An average UK wedding costs about £19,184* (excluding the honeymoon and rings), including the average costs for wedding cake, wedding, rehearsal dinners, reception, décor, professional photography, etc.

Of course, when deciding how much to save for a wedding, you’ll need to consider the type of wedding you want, how many guests you invite and your priorities for your special day. A simple affair in the garden with home catering and a small guest list is going to cost a lot less than a fairytale castle with a black-tie dinner for extended friends and family.

The wedding location will also impact your wedding budget and costs. For example, a wedding in London could be more expensive than one in Scotland as the cost of living is higher, meaning that food, venues, and flowers will all come in at a higher price.

You could also consider holding your wedding abroad, as this could work out cheaper than having a wedding closer to home. Destinations such as Sri Lanka and Mauritius offer bargain wedding packages – plus you are more likely to be guaranteed good weather.

Four ways to save for a wedding

When it comes to planning your dream wedding, clever financial strategies can make all the difference. Here, we’ll explore four effective ways to save for your special day.

1. Set a realistic wedding budget

Planning what you want for your wedding day is pretty easy, but having the budget to make those dreams a reality is the hard part. Creating a budget can help you keep track of your spending and choices. It’s easy for wedding costs to add up, and it’s important to know what you’ve spent and how much you’ve still got left to spend. Start by making a list of everything you want and putting a cost against it, before refining it into a budget that’s realistic for you. It’s a good idea to have clear estimates for everything you want, and compare costs as well.

It’s also worth noting that 48% of couples end up going over budget* when it comes to saving for a wedding, so be sure to factor in every little detail and overestimate your outgoings rather than underestimate to be on the safe side. You might like to use a budget planner to factor in the costs of your wedding and, if necessary, adapt your current expenses to account for your new savings goal.

2. Calculate your monthly income

Once you have an idea of what your target budget is for your wedding, you can calculate how much you’ll need to save each month. It’s important to be realistic about what you can achieve and how you can manage your money to achieve it. Having a specific target and date will make it easier to calculate exactly how much you need to set aside each month.

If your target and timescale are looking too tight, you may need to adjust your expectations or lengthen your saving period. A good way of calculating your wedding budget and savings goals is to work out the number of months you have left until your big day and how much you can save each month. Don’t forget to factor in any existing savings or contributions towards the wedding. The result of this calculation will give you the final figure for your wedding budget.

3. Start saving for your wedding as soon as you can

There’s no one-size-fits-all answer to the question “how long does it take to save for a wedding?”. However, it’s generally a good idea to start as soon as you can. The earlier you can start saving for your wedding, the easier it will be for you to manage the costs. One of the best ways to set money aside while earning interest is to open a dedicated savings account.

To find the perfect match for you and your wedding savings goals, take the time to compare different types of wedding savings accounts. If you want the flexibility of accessing your savings at any time, an easy access account might be right for you. Depending on your wedding budget, you could then set up a regular payment to automatically deposit cash into the account each month. You could also consider a notice account, which combines an element of flexible access with a more competitive interest rate. Fixed rate bonds may be best if you already have a lump sum that you can lock away for a set amount of time and aren’t getting married for a while, as you’ll typically earn an even higher interest rate.

It’s a good idea to check the terms and conditions of any account you open, as some types of wedding savings accounts may charge for early withdrawal.

4. Monitor your wedding savings

Keeping track of your money as you save for your wedding will help you keep on top of your budget and costs. Consider creating a detailed wedding budget spreadsheet or using a budgeting app to track your wedding-related expenses. You could then categorise your costs, set realistic targets, and regularly update the sheet to maintain a clear overview of your financial status.

It’s also important to shop around and compare wedding savings accounts, so you get the best interest rate for the type of savings account that suits you.

How to save for a wedding quickly

If you’re planning to tie the knot soon after getting engaged, consider reevaluating your monthly expenses to see where you can save money. Opening a competitive variable rate notice account or a 1 year fixed rate bond is one of the best ways to save for a wedding, and may also help increase your savings in the short term.

Of course, lowering your overall wedding spend will also mean you reach your savings goal that much faster. The good news is there are plenty of ways you can reduce costs if you’re saving for a wedding on a tight budget. Read on to find out more.

How to plan a wedding on a budget in the UK

A good first step when working out how to save on wedding costs is to agree on the kind of wedding you want, and bear in mind that keeping it simple generally means that you’ll save money. Rather than thinking about the finer details at this point, consider what you want to do and your priorities for your wedding day.

Once you’ve created a budget, calculating how much your wedding might cost and how much you’ll be able to spend, you can then identify areas for cost-cutting and savings. It’s a good idea to put your list in order of priority to ensure you’re spending your money on the things that mean the most to you, while saving money on less important aspects.

14 quick wedding-on-a-budget tips

Wondering how to save money for a wedding without blowing the budget? Our wedding saving tips below are designed to help you plan an affordable wedding and make your money go that little bit further.

1. Choose an unconventional day or season for your wedding

The biggest cost for most weddings is the venue, but if you’re prepared to get married out of season or on a weekday, you might find that venue costs start to drop. The ‘wedding season’ in the UK typically runs from May to October, meaning you’re likely to find cheaper prices throughout late autumn, winter and early spring.

2. Consider an alternative approach to your wedding

While many people have dreams of a big white wedding at a grand hotel or venue, others are happy to cut costs with a more unconventional approach. This might mean tying the knot at a town hall or registry office, followed by a celebration at your home or a family member’s or friend’s house. Not only will you cut costs, your guests will remember the day for its unique charm and personal touch.

3. Double-check that everything’s included

When you’re choosing your venue, make sure that everything you’ll need on the day is included in the cost, so you don’t get any unexpected bills. It’s not unheard of to be charged extra for things like cake knives, crockery or linen. It’s important to ask your venue as many questions as possible, no matter how small or obvious the answer may seem, as this can potentially save you a lot of money. You might also inquire if the venue is willing to drop certain extras that you consider unnecessary, as this can trim costs and help you stay within your budget.

4. Look for cheaper venues

The good news is that there are now a lot of different types of wedding venues to choose from and many are good value, especially if you can keep your guest list down. Look for a venue that hosts simple celebrations with basic food and drink. Your day will still be very special.

5. Ask to be informed of cancellations

Weddings are cancelled for all kinds of reasons, which gives you an opportunity to secure your dream venue at a discounted price. Just keep in mind that this will often mean little notice, potentially having a knock-on effect on your guest list and other preparations for the big day.

6. Make use of family heirlooms

Rather than splashing the cash on new rings, you can save money and make it extra special by using the rings of family members or loved ones who are no longer with you. While you might have to pay to get the rings resized, the cost is often much lower than buying new rings. You might take the same approach to wedding dresses, which can be altered to suit your style and shape. This not only saves money but also adds a meaningful and personal touch to your big day.

7. DIY invitations, RSVPs, table plans and cards

Planning a wedding on a budget means you’ll probably have to do some DIY. Making your own wedding invitations, RSVPs, table plans and table cards can save you a substantial amount of money. Consider handing out your invitations instead of posting them, or look into the growing trend of email wedding invitations.

8. Make use of talented friends

Other expensive aspects of a wedding day include things like photography, hair and makeup, and the DJ. If you’re saving for a wedding on a budget and happen to have friends with talents in any of these areas, consider asking them to do it as a wedding gift for you, or for a small charge to save you some cash.

9. Skip the formalities

Weddings might be considered an old-fashioned tradition, which is why you can get away with scrapping some of the things that many people do on their big day. Skip the canapés, three-course meals, and champagne toasts, and swap them for more budget-friendly and relaxed options such as a buffet or the bring-your-own-booze approach.

10. Shop second-hand

When it comes to things like suits, shoes and your dress, it’s unlikely that you’re going to wear them again. A great way to avoid this expense is to shop second-hand instead, which will not only save you money but reduce your carbon footprint, too.

11. Drop the ‘W’ word

Just like any other special celebration, there’s often a sneaky hidden surcharge for wedding essentials. When shopping for your dress, decorations and other items, avoid using the term ‘wedding’ and see how much you can save.

12. Include a contingency in your budget

When you’re planning your wedding budget, it’s a good idea to include a 5-10% contingency so that you’ll be able to cover any unexpected costs. If you don’t end up needing this money, it could act as a great starter for an emergency fund, or you could put it towards a honeymoon for the two of you to enjoy.

13. Open a wedding savings account

Organising your finances is one of the best things you can do if you’re planning a UK wedding on a budget. You might consider opening a savings account that’s dedicated to your wedding to resist the temptation to spend your funds. This not only helps you stay on track but also lets you earn interest, so you’ve got that little bit extra in your budget.

14. Compare, compare, compare

If you’re exploring different ways to save for a wedding, it’s not just important to compare savings accounts. Comparing costs for everything you’ll be buying, from venues and cakes to photographers and honeymoon travel companies, will help you find the best budget-saving options.

How can I maximise my wedding savings?

If you’re saving for a wedding, you might consider opening a wedding savings account so you can earn interest on your savings. Depending on the amount of time you have to save before your wedding day, it’s worth comparing different types of savings accounts so you can get the most from your savings.

If you have one or two years to save and a lump sum to deposit, a fixed rate bond with competitive interest rates might be right for you. If you have less time to save but still want to maximise your savings, you might consider a notice account.

How to open a savings account at Raisin UK

Quickly and easily open a savings account for your wedding with competitive interest rates from a range of UK banks and building societies by registering for a Raisin UK Account and logging in to apply. It’s free to open an account, and once you’ve been approved, you just need to transfer your deposit and watch your wedding savings grow.

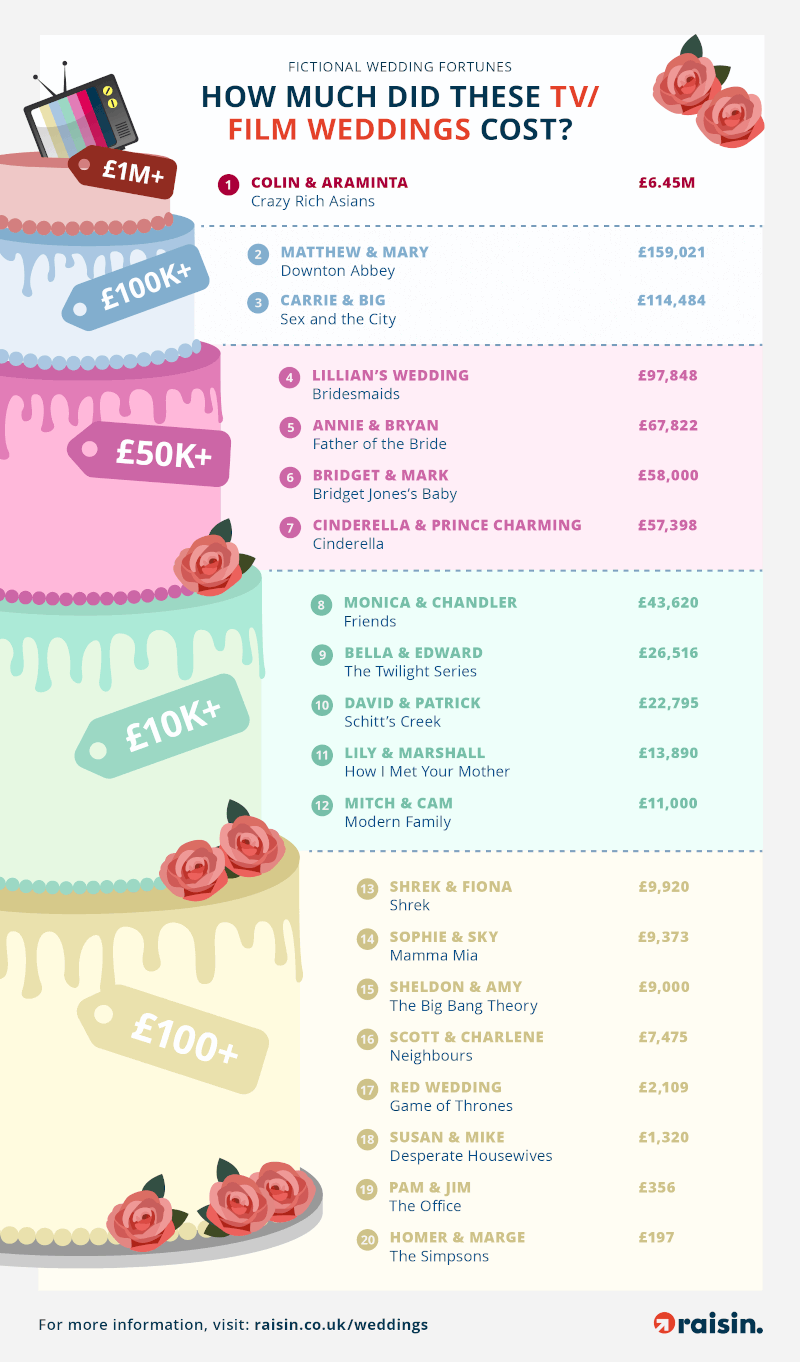

The fictional wedding calculator

We looked at the costs of weddings from TV and film to see how long the characters would need to save up to afford their big days.

They’re the moments that made us smile, sigh, or even brought tears to our eyes. Weddings on TV and film show the happiest moments for some of our favourite characters, and are often what the whole plot has been leading up to. They can take hours, months, or even years to happen, and if we’ve been following the romance from the start, it almost feels as if we’re one of the guests.

So, just how much do these fantasy weddings cost, and could the bride and groom really afford them on their wages? We put all the soppy, romantic stuff to one side and got to the heart of the issue.

The big spenders

Some of the most lavish on-screen weddings have seen hundreds of thousands splashed out on extravagant venues, food and entertainment. However, the most expensive of all was that of Colin and Araminta from Crazy Rich Asians. As the title suggests, they certainly were crazy rich, with a huge family fortune helping them spend a whopping £6.45 million on their romantic bash.

Given that Araminta is heir to a hotel chain’s wealth, this amount of money would have been small change for such an occasion. We don’t imagine they needed to save at all.

Other high spenders were Matthew and Mary from Downton Abbey, whose wedding set them back £159,021. Not a small sum of money by any means, but when your dad is the Earl of Grantham (worth an estimated £800 million in today’s money) we reckon this wedding didn’t break the bank.

Carrie and Big come in third place, with the Sex and the City pair splashing out £114,484 for their long-awaited celebration. As Big was a financier and a fairly prolific investor, he was rumoured to earn millions. Meanwhile, Carrie was a freelance writer charging Vogue 50 cents per word, so she was doing alright too.

The fourth most expensive wedding is that of Lillian in Bridesmaids, costing around £97,848. With her dad primarily funding the ceremony, having a generous parent certainly comes in handy on such occasions.

Wrapping up our top five is Annie and Bryan’s wedding from Father of the Bride. In the film, Bryan’s parents live in a Bel-Air mansion, so it’s not hard to guess where they might have found the £67,822 needed for their ceremony.

Image source: Carrie & Big from Sex and the City splashed out more than £100,000 for their aborted Manhattan nuptials

The around averages

The average UK wedding (excluding rings and honeymoon) costs £19,184*, putting the wedding costs of the next five fictional couples comfortably in the middle range. This makes them much more reasonable to save for, especially for those with well-paying jobs.

At the top of the list is the long-awaited wedding of Bridget Jones and Mark Darcy in Bridget Jones’ Baby. At £58,000, this wedding price tag might have been a little out of reach on Bridget’s publishing salary, but as Mark is a successful barrister, he could easily afford it.

Next up is one of the most famous weddings of all time. When Cinderella married her Prince Charming, it became a dream for many young girls across the world. The prince’s wealth undoubtedly helped, as their big day cost £57,398 to put together, with a little help from the Fairy Godmother coming as a wedding gift.

Could it be any more romantic? When Chandler finally tied the knot with Monica, Friends fans worldwide let out a small cry. With a wedding cost of £43,620, we’d imagine the married couple did too. However, given how much money they were saving on their rent-controlled flat, it could well have been within their means.

Bella and Edward’s wedding came in at just over the UK average, costing the vampire and his wife around £26,516. Saving up for a wedding is definitely easier if you get to live forever, and as Edward’s adopted father was a doctor, his salary no doubt helped too.

At £22,795, the wedding of Schitt’s Creek’s David and Patrick might have seemed extravagant after the Rose family lost their fortune. However, with the couple running a store, the father’s motel business thriving, and their friends contributing to the event, the couple were thrifty when it came to their planning.

Image source: David and Patrick’s nuptials from Schitt’s Creek were a focal point of the series finale

The budget brides

You don’t have to spend big on a special occasion. In fact, some of the big screen’s most famous marriages have come in way under budget and still packed an emotional punch.

In How I Met Your Mother, Lily and Marshall put on their outdoor wedding for only £13,890, using nature to set the scene for their long-awaited party.

Another of TV’s famous couples, Mitch and Cam from Modern Family, spent even less. Their wedding cost only £11,000, which, given Mitch’s work as a lawyer, should have been easy enough to save up for.

Shrek and Princess Fiona slashed costs on their big day in a land far, far away, spending a modest £9,920 to tie the knot. Admittedly, Fiona’s royal background may well have helped her save up the funds, although we’re not sure how they managed to afford Donkey’s wild after-party.

At the lower end of our wedding cost scale, Mamma Mia’s Sophie and Sky only spent £9,373 on their big day, which is fair enough, given how Sophie’s mum stole the spotlight, and we never actually see the two walk down the aisle. We’ll leave what happened next up to your imagination.

The title for the cheapest wedding in film or TV, however, goes to Homer and Marge for their Vegas nuptials in The Simpsons. While Homer and Marge’s romance has lasted more than thirty years for viewers, the on-screen timeline remains a topic of debate. Featured in the third-season episode ‘I Married Marge’, by getting married in a Vegas chapel, they cut huge venue costs, spending only £197 on the whole occasion. It’s safe to assume Marge and Homer would’ve had ample time to save for the meagre cost of their wedding.

Planning a wedding of your own?

Along with buying a house, your wedding day could easily become the most expensive thing you ever splash out on. How big you go is up to you, but whatever you decide to do, our marketplace is home to savings accounts to help you grow your money and make every pound towards your wedding count.

It only takes a few minutes to register for a Raisin UK Account. Once registered, you can click to apply for savings accounts from a range of specialist banks and building societies.

*https://bridebook.com/uk/article/how-much-does-a-wedding-cost-the-2023-uk-average

Methodology:

Each wedding cost calculation includes a combination of canon information, cost of real-life venue hire or approximates based upon fictional location and average costs for things like dresses, flowers, transportation and entertainment, and consolidated by Katie, a wedding planner from Albion Parties.

Image sources:

David & Patrick: https://pyxis.nymag.com/v1/imgs/4e9/33b/ff1ead8267c27676e70a03c65a9c11c240-schitts-creek-recap-2.jpg