4.52%

AER

Fixed rate bond

United Kingdom

(AA)

Rate reducing soon

How do you ensure your money keeps growing despite changing interest rates and economic volatility? It’s a question many savers are asking, especially with economists predicting that The Bank of England base rate is almost guaranteed to fall in May.

On this page, we discuss how interest rates are affected by changes to the Bank of England base rate and what you can do to secure a potentially higher return on your savings.

The Bank of England base rate is expected to drop to 4.25% in May, with the IMF predicting two further cuts in 2025.

Changes to the base rate had a direct impact on the rates offered by partner banks on Raisin UK.

Locking in a higher interest rate with a fixed rate bond can reduce the impact of Bank of England base rate cuts.

The information provided here is for informational and educational purposes only and does not constitute financial advice. Please consult with a licensed financial adviser or professional before making any financial decisions. Your financial situation is unique, and the information provided may not be suitable for your specific circumstances. We are not liable for any financial decisions or actions you take based on this information.

The base rate, also known as the bank rate, is the interest rate paid to commercial banks holding money with the Bank of England.

Changes to the base rate can influence how much banks offer customers in interest for their savings, as well as how much they charge for loans. The base rate isn’t the only influence on interest rates, however, with competitor rates and the ‘spread’ between earnings from borrowing and interest payments also playing a role.

The Bank of England’s Monetary Policy Committee regularly review the base rate to influence the economy and work towards the inflation target set by the Government (currently 2%). Cuts typically occur when inflation is low (to encourage consumer spending) whereas rises are used to control inflation by making borrowing more expensive.

Financial markets have priced in a 100% chance of a base rate cut next month, with the rate expected to drop from 4.5% to 4.25%.

History suggests interest rates offered for savings deposits will follow. To investigate this, we analysed the top five interest rates offered by our partner banks in the 7 days leading up to a base rate announcement and the subsequent 21 days. Sure enough, after a rate cut, all the rates offered by our partner banks dropped as well.

.png)

Account type | Average rate drop |

Easy access | 0.15% |

6 month fixed rate bond | 0.17% |

1 year fixed rate bond | 0.15% |

Here’s what would happen if you deposited £85,000 in a 1 year fixed rate bond at 4.52% AER (our highest rate at the time of writing) vs. a 4.37% AER 1 year fixed rate bond after a hypothetical rate cut of 0.15%.

AER | Initial deposit | Balance after 1 year | Interest earned |

4.52% AER | £85,000 | £88,842 | £3,842 |

4.37% AER | £85,000 | £88,714.50 | £3,714.50 |

By locking in the higher rate, you’d earn £127.50 more in interest.

This difference becomes even starker if the Bank of England cuts rates further. The IMF predicts two more rate cuts in 2025 (after May). If we assume that the average bond rate dropped to 4.22% AER as a result, you would earn £3,587 after a year - a loss of £255 vs. initial rate of 4.52% AER.

In some instances, the average rate drop has been even more significant. After the February 2025 rate cut, for example, 1 year fixed rate bonds dropped by an average of 0.22%. With further cuts expected over the course of 2025, rates could drop even faster and further than the examples in our data.

Learn more: What is a fixed rate bond?

Opening a 1 year fixed rate bond now, barring a major change in fiscal policy, could lock in a higher interest rate than those on offer at the end of 2025.

That potentially means more interest earned and more money to put towards the things that are important to you.

While economists widely expect at least three more cuts to the base rate in 2025, it’s difficult to predict changes in 2026 and beyond.

Inflation is one of the main metrics (but not the only) used to predict the MPC’s actions. If inflation is expected to rise, the base rate will typically follow (and vice versa). The IMF expects inflation to slow to 2.2% by 2026, which suggests the base rate could continue to drop or at least stay at a lower level.

The situation is complicated by US tariffs, especially those on China, which are at 145% at the time of writing. These tariffs could lead to an influx of cheaper goods into the UK from other markets, which could exert a deflationary effect. This outlook may change if, for example, President Trump decided to cancel all of his planned tariffs.

Locking in your savings in a longer-term deposit may be a good strategy in light of this volatility. It could help you secure a higher rate for longer, earning you more interest and getting you closer to your financial goals, as well as offering some peace of mind as the economic landscape continues to shift.

Manage your money across easy access savings, fixed rate bonds and notice accounts with a single log-in.

Open your free Raisin UK account and apply once for access to our entire range of accounts.

Why stick to the high street? Grow your money with accounts from over 40 banks and building societies.

All banks and building societies on our platform offer FSCS (or European equivalent) protection.

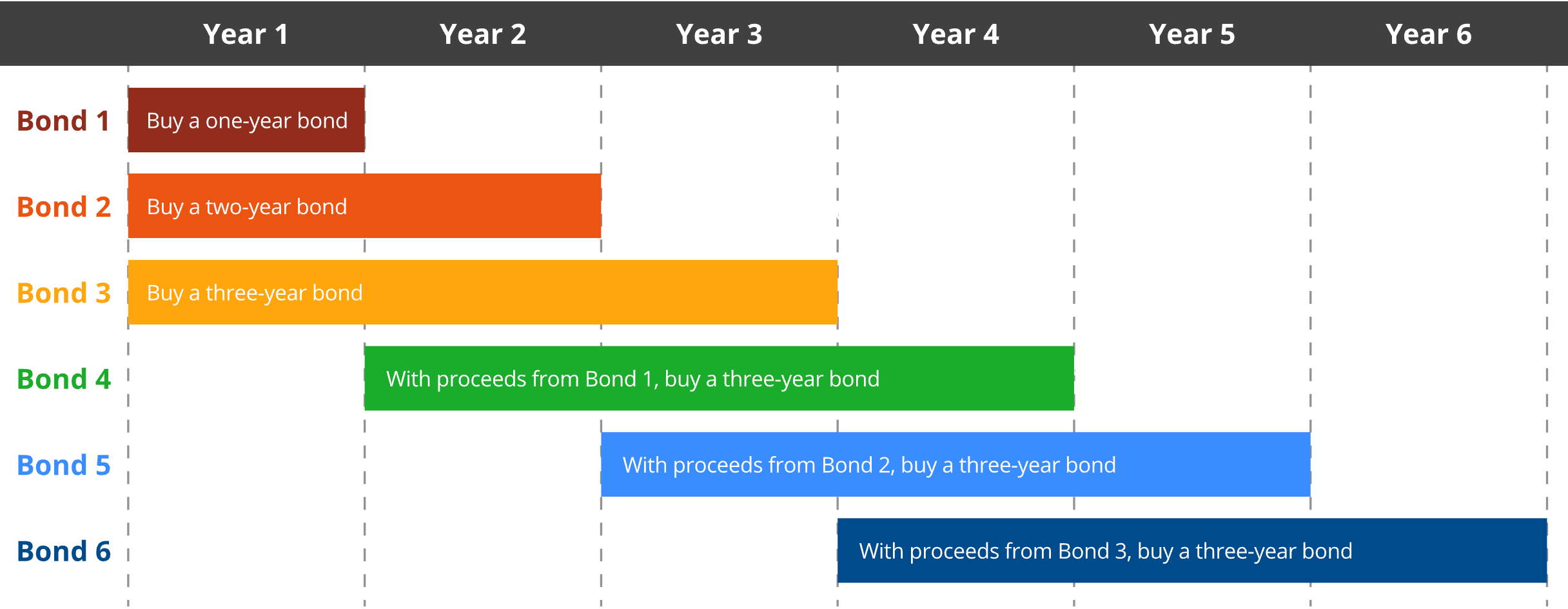

‘Deposit laddering’, otherwise known as the staircase strategy, is a savings approach where deposits are placed across multiple fixed-term bonds with varying terms and interest rates.

When one bond matures, you reinvest the money into a new, longer-term bond, ideally at a higher rate. Over time, you build a “ladder” of bonds, giving you regular access to your funds while still benefiting from better returns on longer-term deposits.

This strategy provides some protection from interest rate changes, with some of your money locked away and the rest available to deposit if rates increase. While you may not earn as much as locking your entire savings away in a single fixed rate, you may earn more long-term as you’re more insulated from changes to interest rates (and you don’t need to predict them, either).

Raisin UK offers high interest savings products from over 40 partner banks and building societies, including fixed rate bonds, notice accounts and easy access savings accounts. Simply create your free account and fill out a single application to compare accounts and grow your money with our partner banks. Start saving today.

What’s in it for me?

Easy to use and good rates

Good choice of rates with app. Useful advanced notifications via the app of rate changes if applicable, so you're always kept informed.

J.W. | Trustpilot | 25th March 2025

Great investing from the start

...provided me with good and profitable investments and the ability to change very quickly, when a new opportunity comes around. It is also secure!

R.F. | Trustpilot | 1st February 2025

A great platform

I have multiple one-year savings accounts with them. Allows me to get literally the market-leading rate and to benefit from FSCS protection.

I.H. | Trustpilot | 9th December 2024