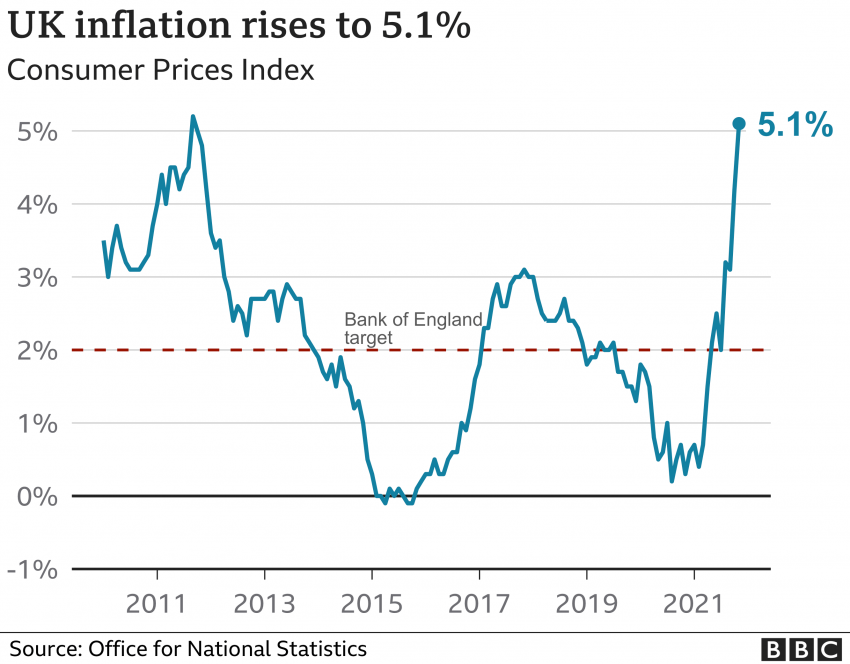

The cost of living surged by 5.1% in the 12 months to November, up from 4.2% the month before, and its highest level since September 2011.

Rising transport and energy costs drove the rise, which was above forecasts of a 4.7% increase, the Office for National Statistics (ONS) revealed in today’s figures.

Commenting on the figures, Kevin Mountford, co-founder of Raisin UK said: “At 5.1%, inflation has reached a 10 year high and has exceeded expectations due to price increases across various products and services including fuel, second-hand car prices, clothing and food – meaning there is no escaping these soaring costs and the negative impact they have on household budgets.

The predictions were that inflation would break through the 5% barrier early in 2022 however, this also adds pressure on the labour market where the industry has already seen demands for wage increases.

The view was that inflation would fall back in 2023 but now the latest figures, coupled with the Omicron variant concerns and the threat of a Christmas lockdown, adds greater uncertainty to the UK’s economic outlook. This makes Thursday’s MPC meeting even more interesting, but I suspect that interest rates will remain the same with possible Bank of England rate increases held off until next month”

Austria

Austria

Finland

Finland

France

France

Germany

Germany

Ireland

Ireland

Netherlands

Netherlands

Poland

Poland

Spain

Spain

United Kingdom

United Kingdom

United States

United States

Other (EU)

Other (EU)