The pension age for women: what’s changed?

The state pension age for women has been steadily increasing since 2010 and will continue to rise until it reaches 68. On this page, you’ll learn more about the increase in the pension age for women and the effect it’s having.

With further increases due in the coming years, we also consider some of the other ways you can boost your retirement fund, such as paying into a personal pension or opening a high-interest savings account.

Key takeaways

: Before the increase in the state pension age, women could claim their pension once they reached 60

: The state pension is funded through National Insurance contributions made by employees working in the UK

: The current state pension age for both men and women is 66, but this will continue to increase in the coming years

What is the women’s state pension?

The state pension for women (and, indeed, for everyone) is a regular payment made by the government to those who’ve reached eligible state pension age, giving everyone a solid financial base when they retire.

The state pension is funded through National Insurance contributions and how much you’ll get depends on the number of National Insurance qualifying years you’ve worked. For this reason, not everyone is eligible for a state pension.

What is the female state pension age?

Currently, the state pension age for women in the UK is 66.

From the 1940s until April 2010, the state pension age was 60 for women and 65 for men. However, the government’s policy on women’s state pension age changed in the 1990s, when a timetable that would equalise the state pension age for men and women was agreed. The government’s decision under the 1995 Pension Act was to increase the state pension age for women from 60 to 65 between 2010 and 2020.

However, the coalition government of 2010 decided to accelerate this timetable. They legislated in the 2011 Pension Act that by April 2016, the women’s state pension age would increase to 63, and to 65 by November 2018. In October 2020, the state pension age increased to 66 for both men and women.

Between April 2026 and April 2028, the state pension age will rise to 67. This rise will take place in stages, with people born between 6 April 1960 and 6 March 1961 qualifying for their state pension after reaching 66 and a specified number of months. A further increase in the state pension age to 68 is planned between 2044 and 2046.

Why did the government increase the state pension age for women?

The change in women’s state pension age in December 2018 was considered quite sudden, with the age increase to 65 brought in over two years earlier than originally planned. The reason given was that life expectancy in the UK had risen faster than expected since the last revised timetable, by 0.15% since 2019, and 1.55% since 2010.

Raising the retirement age for women was also a way for the government to control its expenses. Increasing the pension age for women and bringing this increase forward means fewer women can claim their pension, making pensions more affordable for the government.

The decision sparked a lot of controversy and led to the rise of movements like BackTo60 and Women Against State Pension Inequality (WASPI), which argue that the new state pension age for women is unfair.

How did the state pension age increase affect women?

Due to the age increase for women’s state pension, over 3.8 million women born in the 1950s have suffered detriment. The BackTo60 campaign argues that the changes were discriminatory, while others criticise the change for being too sudden and not giving women enough time to prepare for it. Here’s how it has affected women, particularly those born in the 1950s:

- When the state pension age increased in 2010, many women born in the 1950s were either approaching or very close to their original state pension age of 60

- This lack of notice meant that many women didn’t have time to adjust or make alternative financial arrangements that would have otherwise eased the transition

While the government heard these complaints, they were ultimately unsuccessful. Organisations like WASPI are still campaigning to reverse this decision, even though women’s state pension age is now 66.

While the state pension age for men is also increasing, the change has particularly detrimental effects on women. In general, women are more affected by this age increase because:

- Only 52% of women are saving for retirement, compared to 60% of men

- Female pensioners’ net incomes only equate to about 85% of male pensioners’

- Over two-thirds of pensioners who are currently living in poverty are women

Is the female State Pension age going to increase again?

Yes, the Government plan to increase State Pension age to raise it from 66 to 67 between 2026 and 2028. This would affect those born on or after 6 April 1960. An additional increase is planned between 2044 and 2046, which would raise the State Pension age from 67 to 68, but this may be changed or brought forward.

What are the eligibility requirements for claiming a state pension?

You must meet the following requirements to be eligible to claim a state pension in the UK:

- You must work in the UK

- You must reach the state pension age determined by the government

- To claim a full pension, you must have made National Insurance contributions for 35 years (although these years don’t have to be consecutive), if you qualify for a state pension after April 2016

- If you’re not working, you can make voluntary National Insurance contributions, or the government can credit them for you

What are the other ways I can save for retirement?

To help prepare for the next state pension age increase, you might want to consider paying into a personal pension and/or a workplace pension. Workplace pensions are tax-efficient as they allow you to contribute to your pension through your monthly salary. Plus, your employer will automatically contribute on your behalf when deducting pension contributions from your salary.

Another way to put money aside for your retirement is to open a savings account, especially one that pays a high interest rate, such as a fixed rate bond. They tend to offer the most competitive rates of all account types as your money is locked in for a set duration, typically one year, two years, three years, five years or six months.

Start saving with Raisin UK

You can compare savings accounts with competitive interest rates on the Raisin UK marketplace. Simply register for a Raisin UK Account and choose the savings account that suits your needs, from flexible easy access savings accounts to fixed rate bonds between one year and five years.

Our partner banks are covered by the Financial Services Compensation Scheme (FSCS), which protects deposits into savings accounts up to £85,000 per person, per bank.

Raisin Research: The Gender Pension Gap in the UK

Most working adults will have a workplace pension, where savings are put aside each payday to build a fund for retirement. But are there differences in how much is saved depending on whether you are male or female? Raisin UK has looked into the UK gender pension pay gap, uncovering just how much women will have in their pension pot at the end of their career compared to men.

By looking into different industries, the fluctuations of pension payments, how long men work compared to women over a lifetime, and the effect of children and maternity leave on pensions, Raisin UK has discovered that alongside a gap in general savings by gender, there is also a gender gap in pensions.

Here is a summary of our findings:

If a woman has no children, she is more likely to have an extra £11,315 in her pension pot at the end of her career than a woman with children

Women lose out on £783 per annum after having a child, and every child after

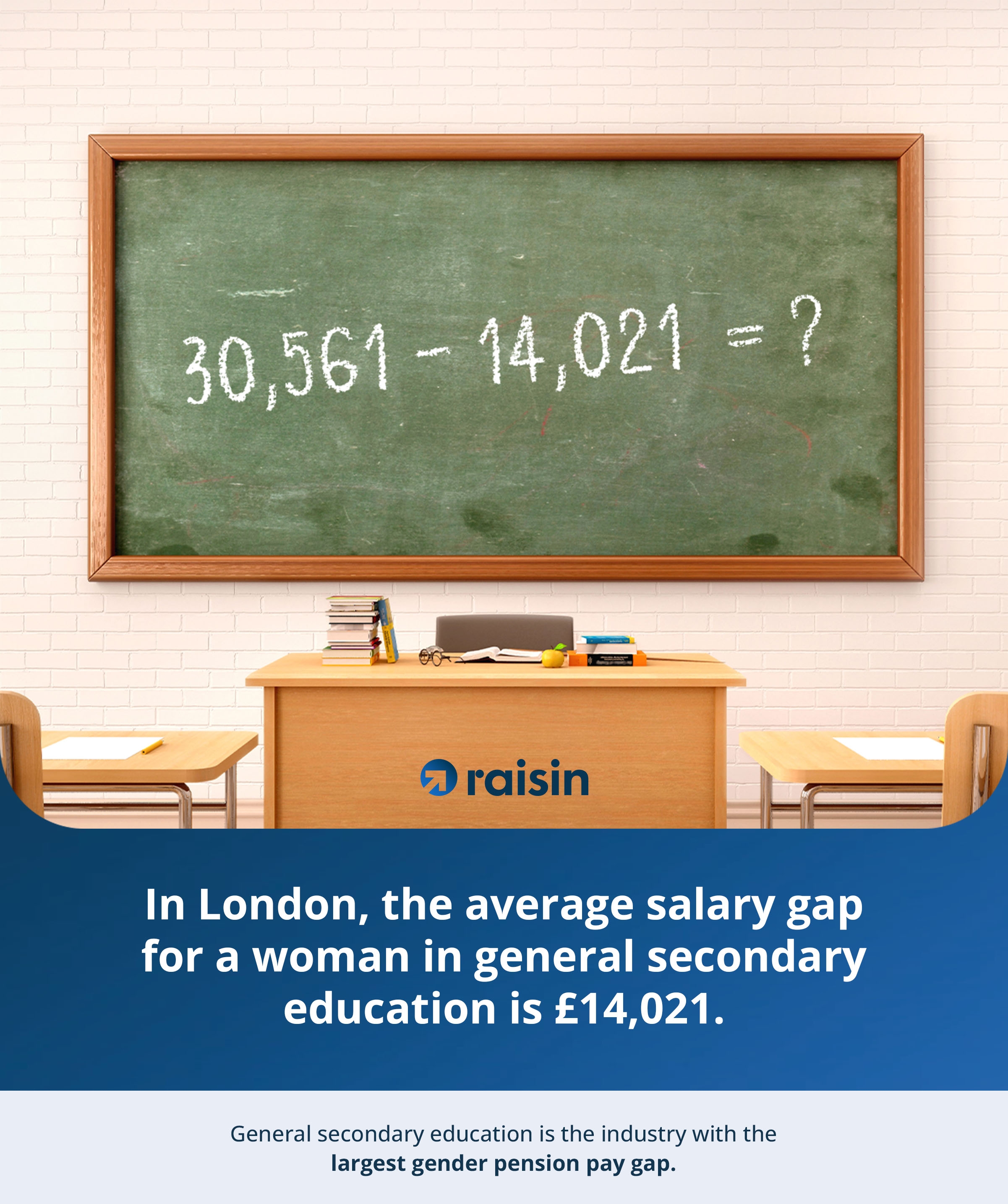

General Secondary Education is the industry with the largest gender pension pay gap

Per month, the average gender pension pay gap for women is -15%, contributing £31 less than men to their pension

On average, men work 1,260 days more than women in a lifetime (5 years) due to part-time work/maternity leave

On average, men will contribute 15% more to their pension per month than women

Our study found that, on average, men in full-time employment will contribute £238 towards their pension monthly, compared to women at £206. This difference of -£31 may not seem significant, but this adds up over the decades of your career.

But, why do men contribute so much more to their pension than women? There are a multitude of reasons, one of the biggest being that, on average, men will work an extra five years in a lifetime compared to women due to factors such as maternity leave and more women working part-time than men.

How maternity and paternity leave affect pension savings

Although it may seem a dated notion of men as the ‘breadwinners’ and women as the ‘caregivers’, this is still reflected in maternity and paternity leave and the gender split of full-time and part-time employment.

Our data discovered that approximately 90% of men retain full-time employment (45 hours a week) in the first ten years of fatherhood, compared to 73% of women returning to work in the first year of having children. Approximately 80% of women return to work after maternity leave within ten years. However, the average working hours across this period reduced significantly to 27 hours a week (part-time employment). This means that, on average, women could lose earnings of -£9,795.49 post-full maternity leave.

How having children affects pension savings

The pension pay gap not only differs between genders but also contrasts between women with and without children. A woman with no children is likely to accrue a pension of £109,031, compared to a woman with a child accruing £97,716.

This is likely because women with children often participate in part-time work rather than full-time and take time off for maternity leave.

How the gender pension gap differs by industry

Our study also looked into how pensions differ by industry. We found that in London, the largest salary gap by industry was in General Secondary Education, with an annual average salary gap of -£14,021 and an annual average pension gap of -£1,122, compared to men.

Industry | Annual average salary gap (women in London) | Annual average pension gap (women in London) | Annual average salary gap (women in Manc) | Annual average pension gap (women in Manc) |

Supermarkets | -£6,942 | -£555 | -£6,407 | -£513 |

Charities | -£8,639 | -£691 | -£7,974 | -£638 |

Temporary-Employment Placement Agencies | -£9,792 | -£783 | -£9,031 | -£722 |

Business Process Outsourcing Services | -£9,226 | -£738 | -£8,482 | -£679 |

General Secondary Education | -£14,021 | -£1,122 | -£12,925 | -£1,034 |

Construction Contractors | -£10,255 | -£820 | -£9,534 | -£763 |

Direct Selling & Marketing | -£10,458 | -£837 | -£9,692 | -£775 |

Full-Service Restaurants | -£9,212 | -£737 | -£8,511 | -£681 |

Universities | -£12,735 | -£1,019 | -£11,789 | -£943 |

Secondary education had the largest gender pension gap for adults working in and outside of London

For adults working full-time in general secondary education, the average gender pension gap was -£1,034 for women outside of London. University institutions came in a close second both inside and outside the capital, with a pension gap of -£1,019 and -£943, respectively.

It is perhaps no surprise that the larger the gender pay gap, the larger the pension pay gap.

Methodology

- Salary data was sourced from the ONS

- Salary sacrifice schemes: Some employers offer salary sacrifice schemes for childcare, allowing employees to pay for childcare directly from their salary before tax, potentially reducing their overall tax bill. This has not been accounted for within the data.

- Tax-Free Childcare: Eligible families can claim up to £2,000 per year per child towards childcare costs if you earn £100,000 and your partner's (if you have one) is below £70,000. Given the average salaries noted within this document, these thresholds have not been applied to the dataset.

- Automatic Enrolment (AE) into workplace pensions was introduced in 2012 to help address a decline in private pension saving and to make long-term saving the norm. In addition, the introduction of the flat-rate new State Pension in 2016 has reduced the gap in State Pension payments men and women receive.

- You can't take pension benefits before the normal minimum pension age (NMPA) of 55 (rising to age 57 in 2028) unless you have a protected pension age or are in ill health.

- The State Pension age is currently 66 years old for both men and women but will start gradually increasing again from 6 May 2026.

Save smarter with the Raisin UK newsletter!

What’s in it for me?

Receive exclusive updates on market-leading rates

Ensure you never miss a bonus offer

Keep your finger on the pulse with the latest financial news