Which financial personality type are you?

Dating is hard enough in 2024 without adding financial compatibility into the mix. But during a cost of living and rental crisis in the UK, it’s hard to ignore the topic of money nowadays. That’s why 43% of Brits say they often experience feelings of hopelessness and despair due to finances.

Can it really work if your beau loves splashing the cash and you’re a bargain-hunter? Well, as they say, love conquers all. We look at the five financial personality types you might find in today’s dating pool of Millenials and Gen Z-ers, based on our recent financial health survey of Britons.

Select the statement about money that you most identify with:

a) Money comes and goes – I don’t really think about it very often

b) I take savings seriously: my biggest goal is being able to retire early

c) I like to enjoy life and treat myself, but I keep one eye on the future, too

d) Money is there to be enjoyed – what’s the point in having it if you can’t spend it?

e) I’m always looking for new opportunities to maximise my money without much effort

The moneymaker

The stats: 15% of the dating pool save over a third of their salary every single month, while 16% use budgeting apps and tools.

The moneymaker believes that earning more money is the secret to happiness, and is focused on making as much as possible. They know exactly what their financial goals are, and how they are going to get there. Their ultimate goal is achieving financial freedom – they may be a fully paid-up member of the FIRE movement – or they have a specific goal amount of money they want to save.

It’s you if… your financial spreadsheet is your most visited web page

How to spot them… they’ll never willingly suggest a dinner date – there’s no time for frittering money when you want to be a millionaire by age 50

The rainy day saver

The stats: 25% of the dating pool ‘regularly’ save a percentage of their income, with 44% describing their financial situation as ‘stable’.

This type enjoys a healthy balance of enjoying life and the odd treat, while still having one eye on the future. They consistently put money away each month, so don’t have to worry too much about potential unexpected expenses.

It’s you if… you have a safety net of savings for 3-6 months

How to spot them… they choose the second cheapest bottle of wine on the menu, of course

Rockefeller

The stats: 15% of the dating pool say they never worry about their financial situation, with 62% preferring immediate access to their money over locking it away.

This spender likes the finer things in life: designer labels, fancy restaurants and expensive holidays. Whether they actually have the income to fund this kind of lifestyle is irrelevant – they don’t like to look at price tags and feel happiest when the likes are rolling in on Instagram posts of them living their best life.

It’s you if… you don’t bat an eyelid at spending £15 on a cocktail

How to spot them… it’s easy – just count how many designer labels they’re wearing

The investor

The stats: 24% of the dating pool say they have a ‘high’ level of financial knowledge, and 9% currently invest in cryptocurrencies.

Investors are motivated by the potential return on investment; they want high returns without much effort, and are interested in getting something for (nearly) nothing. They may be a crypto enthusiast, and you’ll find them checking their investments several times a day.

It’s you if… you’re always looking for new opportunities to make your money go further

How to spot them… when you come back from the bar, they’ve got a crypto website up on their phone

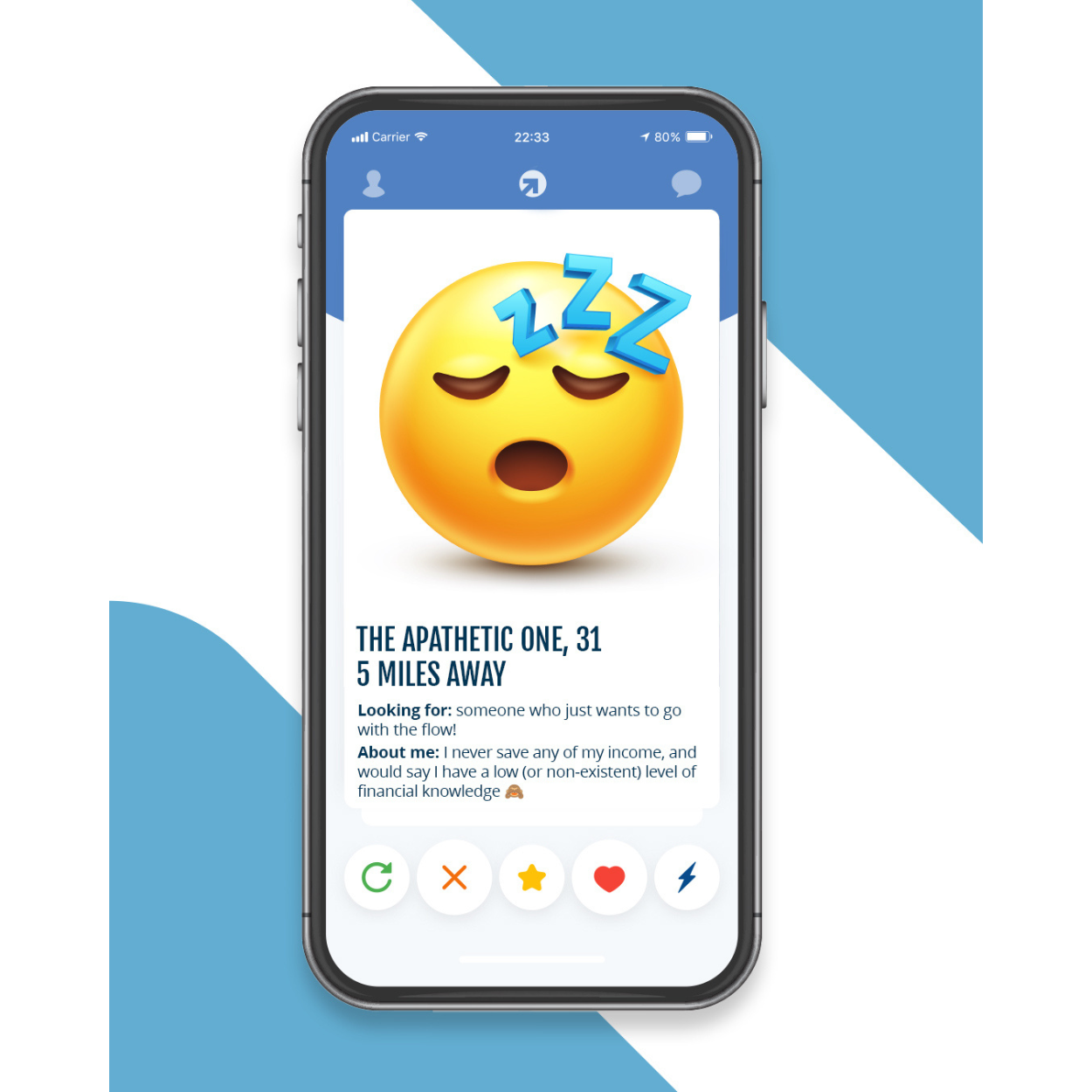

The apathetic one

The stats: 25% of the dating pool say they have a ‘low or zero’ level of financial knowledge, while 14% never save any of their income.

While not having to think about money involves a certain amount of privilege, this type would rather watch paint dry than create a spreadsheet or think about pensions. They believe that everything will work out in the end, and don’t have any interest in, well, interest.

It’s you if… any savings you have are in your current account – it’s just not worth the hassle to move it, is it?

How to spot them… their eyes glaze over when you mention you’re saving up for something

Savings for every personality type

Whatever your lifestyle and attitude to money, there’s no downside to having some money saved. From competitive high-interest fixed rate bonds to flexible easy access savings accounts, discover a range of deposit-protected options on the Raisin UK marketplace.

Methodology

Raisin UK surveyed 5,001 adults from 17 UK cities in July 2023. Data based on respondents aged 18 – 44. More information available on request.