Could your household save nearly £5,000 a year?

Guilty pleasures, hidden fees, and forgotten subscriptions cost Brits £129 billion annually, but experts say spotting these could help save them nearly £5k every year.

According to an expert, Brits are ‘flushing nearly £5k down the drain’ every year on guilty pleasures, hidden fees, and forgotten subscriptions, with the nation losing a staggering £129 billion annually. But with Brits continuing to feel the squeeze, now’s the time to start ‘trimming the fat’ and saving big.

A recent study by Raisin UK uncovered sneaky expenses silently draining your bank account. The average British household loses £12 daily, up to almost £4,600 yearly. But identifying and slashing these unnecessary costs could leave you nearly £5,000 richer every year!

Financial experts have long warned against splurging on takeaways or pricey coffees, but Raisin UK’s research shows that the real culprits are often overlooked. Whether it’s gym memberships you never use out of January, subscriptions you’ve forgotten about, or even food waste, the small stuff adds up fast. But by making a few smart changes, you can hang onto more of your hard-earned cash without sacrificing the things you love.

Could your household save nearly £5,000 a year?

Start with your finances. Did you know you could save £307 a year by refinancing your personal loans using zero-interest credit cards? Millions of households also miss out on unclaimed benefits like Universal Credit and Council Tax Support, which can add up to a tidy sum. And if you’ve got savings sitting in a low-interest account, you’re effectively throwing money away. Switching to a more competitive savings account could earn you an extra £307 a year while moving your savings out of a current account could bag you an extra £450.

Remove unnecessary direct debits to save an extra £500

We’re all guilty of hanging onto subscriptions we barely use, whether the gym, streaming services, or even lottery tickets. The average Brit wastes £210 a year on unused gym memberships alone. You could save hundreds by shopping around for better deals on mobile plans and ditching those unused subscriptions. And while you might feel lucky buying lottery tickets, the odds aren’t in your favour – especially regarding finances, with Brits spending £121 a year.

Simple lifestyle changes could add an extra £1k to your bank every year

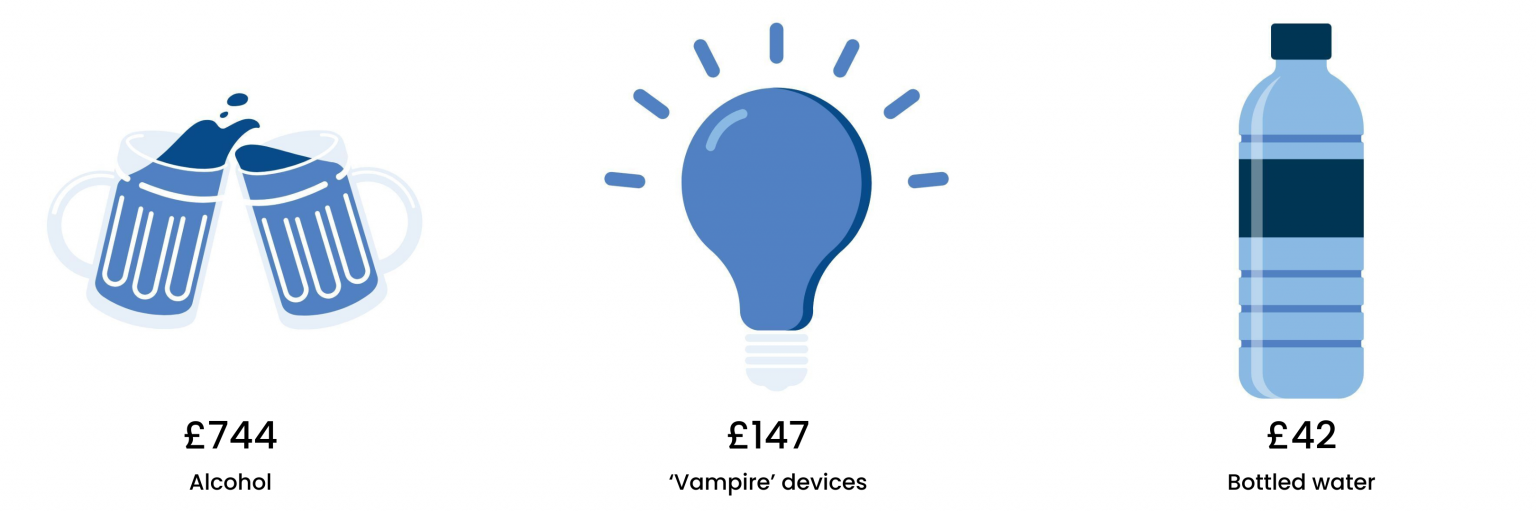

Don’t let your money go to waste at home, either. From £42 a year on bottled water to £147 on so-called ‘vampire devices’ that suck energy while on standby, there are plenty of small changes that add up to big savings. And don’t forget those unused gift cards languishing in your wallet – £400 million worth went unspent last year. It’s time to cash in!

Research by Raisin UK identifies kettles, phone and laptop chargers, game consoles, and fridges as the worst culprits among vampire devices. For instance, leaving a kettle on standby all year could add up to £40 on your energy bill. Similarly, phone chargers and game consoles can add a few pounds daily, so switching them off at the plug is wise when not in use. While you can’t turn off your fridge without compromising food freshness, you can help it run more efficiently. Keep it about two-thirds full to allow proper air circulation, and regularly remove any ice buildup.

Methodology

Money Waste Methodology

Raisin UK looked at 15 areas of spending and calculated the total cost per household per day and per year, based on census data. The census data and 15 areas of spending were based on the sources listed below.

Census data

Total number of UK households

The most-recent total number of British households (2023) is given as roughly 28.4 million according to figures from the Office for National Statistics.

Total number of UK inhabitants (15 and over)

Raisin UK used the most-recent Census data (2022) on the age distribution of Brits to deduce the percentage share of inhabitants 15 and up (82.6%). Extrapolated estimate figures from the Office for National Statistics put the current UK population at roughly 67.8 million, resulting in 56.7 million UK inhabitants 15 and over.

Finance and Banking

Loss of interest (current accounts)

In a recent Financial Conduct Authority report, the Bank of England puts the estimated volume of non-interest bearing deposits at £250bn. This equals roughly £10,000 per household. If this money were to be invested in overnight savings accounts at an interest rate of 4.5%, this would earn the average household £450 a year in interest, or £12.69bn taking the UK at large.

Loss of interest (low-yield savings account)

An extra £10,000 per household kept in a low-yield savings account, with averages currently at 3.17%, shifted to a one-year term deposit at an interest rate of 6%, would earn households an extra £283 in interest.

Unclaimed benefits

In May 2023, Policy in Practice published a new analysis, estimating that £18.7bn pounds in benefits, for which people and households would be eligible, go unclaimed each year. This equals an average of £663 per household.

Credit card debt

The Money Charity Statistics Dashboard currently reports a total of £66.7bn in UK credit card debt. Debt Free Advice puts the average interest rate on credit card debt at 22%. With personal loans currently at average interest rates of roughly 9%, refinancing could bring £8.67bn in relief for Brits, or over £300 per household.

Monthly subscriptions and direct debits

Unused gym memberships

In 2019, Fridge Raiders carried out a survey amongst the UK population, finding that roughly £4bn is wasted each year. With monthly membership fees currently £10 higher than just 4 years ago, this figure will now have grown to £5.69bn, or just over £200 for the average household.

Lotteries

The National Lottery is part of the fabric of British society. The company reports that, for every pound spent, roughly 57p is paid out in the form of winnings. The 2022/23 annual report puts the ‘losses’ of lottery players at £3.44bn, or £121 per household.

Streaming subscriptions

Streaming services have heralded a new era of unprecedented convenience in media consumption. But do we really need Netflix, HBO+, Disney+, Amazon Prime, and Apple TV? The streaming market is massive, at an estimated £3.3bn, or roughly a tenner per average household per month. Surely, we could cut back on some of those subscriptions.

Not switching energy/gas suppliers

Switching can be a hassle, but it’s usually worth your time and effort, especially if you haven’t switched in a while. Better Housing Better Health reports government estimates that the average household can expect to save £200 a year by switching. That adds up to £5.6bn a year nationwide.

Not switching mobile plans

A recent which.com survey revealed that the ‘Big Four’ providers charge customers an average of £22.37 a month for their mobile plans. That’s significantly more than the £19.01 bill other customers pay. If these users were all to switch, the average Brit could save roughly £40 a year, adding up to £2.28bn at the national level.

General home expenditure

Food waste

Food waste is a massive societal issue. In 2015, the UK ranked among the ‘worst offenders’ in the EU, of which it was then still part. In spite of reduction efforts, the Waste and Resources Action Programme puts the value of food waste at more than £19bn a year. That’s £673 per household per year.

Unused gift cards

A 2023 Gitnux Marketdata Report puts the total value of unused gift cards over the course of five years at £2bn, or £400m annually. The total money wasted per household adds up to over £14 per year.

Bottled water

Virtually everyone in the UK has access to excellent tap water. Nevertheless, the bottled water market continues to thrive. Whether this is down to convenience, or unjustified fears over tap water quality: the tab, or tap, ran up to around £1.2bn a year in 2022.

Power waste

Devices left on standby or plugged in when not in use are a significant drain on household energy. With the latest OfGem Price Cap and a study by British Gas as reported by the BBC, the most recent figures indicate that energy wastage now adds an average £165 to the annual energy bill for UK households, amounting to approximately £4.65bn nationwide.

Tobacco

Smoking is an unhealthy habit, but tobacco consumption and revenues remain high. A Market Report puts the revenue from tobacco products in the UK at £14.9bn in 2021, with a more or less steady outlook. This is equivalent to £528 per household.

Alcohol

Like most developed countries, Brits love their drink. NimbleFins dove into the official statistics and discovered that the average UK household spends round about £744 on alcohol each year — “£484 for consumption at home and £260 on drinks out of the house”. This adds up to a total tab just short of £21bn.