Photo by Joshua Hoehne on Unsplash

With the average student in England totting up a whopping £40,800 worth of debt from their university degree*, how much you could take home in your pay packet once you graduate is a big deciding factor when choosing what and where you’re going to study.

Using data from Adzuna and the HESA (High Education Statistics Agency) Graduate Outcome survey, we unveil the top universities where you can get the most bang for your buck, as well as the courses that will lead to the highest salaries.

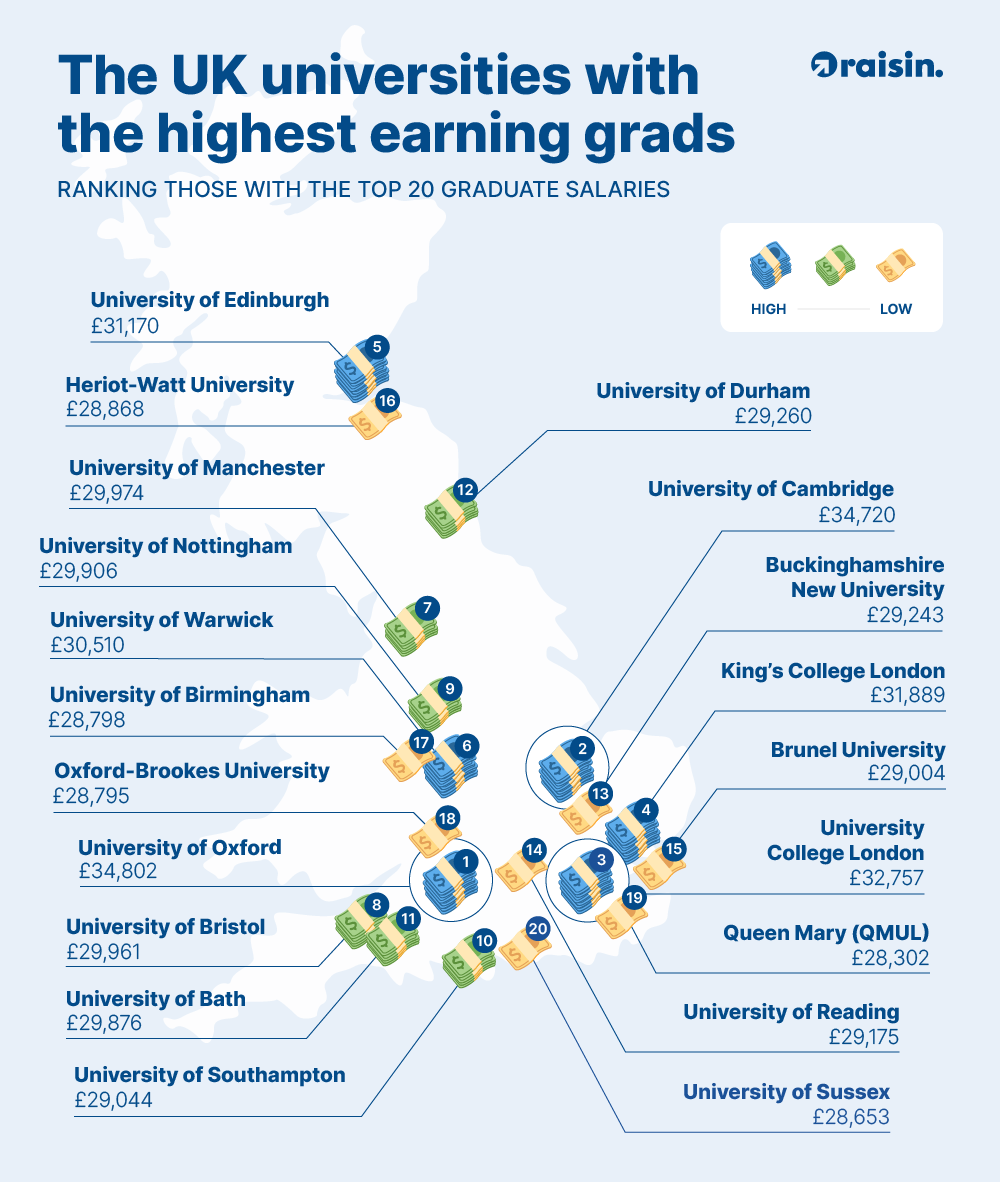

So which universities come out on top for high-earning grads?

Oxford and Cambridge graduates heading for the biggest salaries

Using data from Adzuna, we have revealed the universities where graduates can earn the most within five years of graduating. It’s no surprise that two of the oldest, most famous and wealthiest universities in the UK, the University of Oxford and the University of Cambridge, sit at the top of our list.

Graduates of the prestigious University of Oxford can expect to be earning an average salary of £34,802 within five years of graduating. The UK’s second-oldest university, the University of Cambridge doesn’t trail too far behind, with graduates expected to earn an average of £34,720 annually after graduating.

Our capital city is a high earner hot spot too. Although this could be in line with the London cost of living, with graduates from the University College London on track to earn £32,757 and neighbouring students at King’s College London expected to earn an impressive £31,899.

The Scottish capital of Edinburgh also makes it into the top five, with graduates expected to earn an average annual salary of £31,170 within five years.

47% of medicine & dentistry graduates earn over £39,000

When it comes to the courses that produce the graduates with the highest earnings, unsurprisingly medicine and dentistry come in first, with 47% of the students surveyed going on to earn over £39,000. Both fields require many years of self-investment, incurring university fees alongside intense study and job pressure, but in return yield higher salaries and career progression.

The top 20 highest paying degrees in the UK

Ranking the percentage of students going on to earn over £39,0000:

|

# |

Degree subject |

No. of students earning over £39k |

Total No. of students surveyed |

% earning over £39k after graduating |

|

1 |

Medicine & Dentistry |

1,630 |

3,490 |

47% |

|

2 |

Engineering & Technology |

1,790 |

9,640 |

19% |

|

3 |

Combined |

100 |

550 |

18% |

|

4 |

Architecture, Building & Planning |

655 |

3,895 |

17% |

|

5 |

Business & Administrative Studies |

2,650 |

15,975 |

17% |

|

6 |

Law |

900 |

5,760 |

16% |

|

7 |

Computer Science |

815 |

5,730 |

14% |

|

8 |

Education |

2,055 |

17,425 |

12% |

|

9 |

Veterinary Science |

45 |

390 |

12% |

|

10 |

Subjects allied to Medicine |

2,180 |

20,000 |

11% |

|

11 |

Mathematical Sciences |

260 |

2,640 |

10% |

|

12 |

Unknown Subject |

65 |

735 |

9% |

|

13 |

Social Studies |

1,225 |

14,285 |

9% |

|

14 |

Physical Sciences |

395 |

6,530 |

6% |

|

15 |

Biological Sciences |

655 |

13,755 |

5% |

|

16 |

Historical & Philosophical Studies |

230 |

4,905 |

5% |

|

17 |

Languages |

200 |

5,330 |

4% |

|

18 |

Creative Arts & Design |

235 |

8,660 |

3% |

|

19 |

Mass Communications & Documentation |

80 |

3,065 |

3% |

|

20 |

Agriculture |

45 |

1,735 |

3% |

With 19% of graduates going on to earn over £39,000, engineering and technology is a core subject area that produces high earners, along with combined courses with 18%. Combined courses are when a student studies parts of two degrees in parallel, bringing a mix of skill sets to the table that makes your self-investment pay off in the future.

Which degree subject salaries have increased faster than inflation?

Understanding which degree subjects and universities produce the highest-earning graduates is integral to the decision of what and where to study, but equally important is understanding whether the average salary for your field of choice is growing slower than the rate of inflation.

Where salaries are vs. where salaries should be

Are salaries growing in line with general inflation

|

# |

Course |

Actual Growth |

Expected Growth |

Salary Difference |

|

1 |

Medicine |

£29,688.13 |

£29,763.93 |

-£75.80 |

|

2 |

Computer Science |

£14,596.68 |

£14,633.70 |

-£37.26 |

|

3 |

Veterinary Medicine |

£13,432.41 |

£13,466.70 |

-£34.29 |

|

4 |

Architecture, Building & Planning |

£13,432.41 |

£13,466.70 |

-£34.29 |

|

5 |

Architecture |

£12,579.12 |

£12,611.24 |

-£32.12 |

|

6 |

Economics/p> |

£12,469.76 |

£12,501.59 |

-£31.83 |

|

7 |

Mathematics |

£12,244.38 |

£12,275.64 |

-£X30.29 |

|

8 |

IT |

£12,228.31 |

£12,259.53 |

-£31.22 |

|

9 |

Geography |

£11,862.46 |

£11,892.75 |

-£30.29 |

|

10 |

Politics |

£11,800.27 |

£11,830.39 |

-£30.12 |

|

11 |

Chemistry |

£11,623.11 |

£11,652.79 |

-£29.68 |

|

12 |

Business Studies |

£11,187.73 |

£11,216.30 |

-£28.57 |

|

13 |

Biological Sciences |

£10,998.35 |

£11,026.43 |

-£28.08 |

|

14 |

Law |

£10,734.19 |

£10,761.59 |

-£27.40 |

|

15 |

History |

£10,345.28 |

£10,371.70 |

-£26.42 |

|

16 |

Marketing |

£10,111.87 |

£10,137.69 |

-£25.82 |

|

17 |

Education |

£9,642.60 |

£9.667.22 |

-£24.62 |

|

18 |

Psychology |

£9,635.26 |

£9,659.86 |

-£24.60 |

|

19 |

Art/Design |

£9,609.05 |

£9,633.59 |

-£24.54 |

|

20 |

Web & Digital Media |

£9,270.47 |

£9,294.13 |

-£23.66 |

Although the difference is minimal, students of all the academic subjects within our research won’t see their salaries grow in line with the general rate of inflation. At the top end of the scale, medicine sees a minus £75.80 difference between actual salary growth to what it should be in line with inflation. So although as a degree subject it produces the highest-earning graduates, the salary growth over time could be slower than some other professions and industries.

How can you save for your future?

Choosing your university path is such a huge choice and not a decision that should be taken lightly. Prospective students can call on their dreams to influence their choices, but it’s also important to be aware of how your choice can impact your finances and lifestyle in the long-term.

At Raisin UK, our marketplace is home to a range of savings accounts, including fixed rate bonds, notice accounts and easy access savings, that could help you prepare for your future.

Methodology

Using the HESA (High Education Statistics Agency) Graduate Outcome survey, we were able to look at the characteristics of graduates. Here we utilised the information on the earnings of those graduates and their degree subject area, as well the universities attended.

For the universities that produced the highest-earning graduates, we did not include places where less than 100 students were surveyed.

For our inflation index, we used the 2020 salaries for the most in-demand jobs in the UK, using a salary inflation calculator to find out their growth since 2000. Then using a general inflation calculator, we were able to understand that between these years, general inflation had outgrown wage inflation by 0.14%. From this data, we were able to see where salaries had or had not grown in line with general inflation.

*https://www.statista.com/statistics/376423/uk-student-loan-debt/

Austria

Austria

Finland

Finland

France

France

Germany

Germany

Ireland

Ireland

Netherlands

Netherlands

Poland

Poland

Spain

Spain

United Kingdom

United Kingdom

United States

United States

Other (EU)

Other (EU)