Investing in property

Home › Investments › Investing in property

If you’re looking to invest in something that is unlikely to lose value and is a way to earn a fairly stable income, investing in property may be something you’re already considering.

In this guide, we look at the different types of property investments, why investing in property might be a good option for you, how to invest in property and what the risks might be. We also consider the alternatives to property investing, such as stocks and shares and competitive savings accounts like fixed rate bonds.

Investment options: There are several ways to invest in property, with buy-to-let, property developing and REITs being some of the most popular routes

Returns: While investing in property can often provide a good return, it’s important to be aware of the risks involved

Expenses: There are more expenses associated with property investing than other types of investments, which you’ll need to factor in before you commit

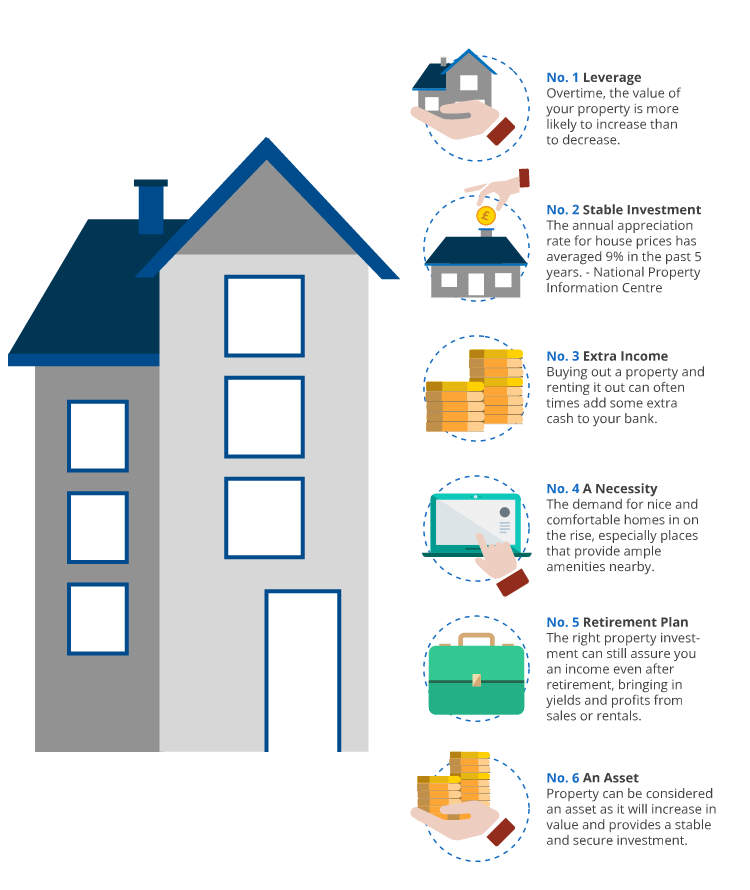

Why invest in property?

The short answer is that investing in property is typically seen as a way to make money. People who invest in property usually go down one of three routes in order to make money from their investment. These three routes are as follows:

- Renting – When you buy a property and rent it out, you’ll stand to earn a stable monthly income from your tenants.

- Selling – Some investors purchase properties, refurbish or renovate them, and sell them later at a higher price. This is also called ‘property flipping’. They may often refurbish the property themselves or at the lowest possible price so they make more money.

- Property investment fund – If you don’t want to buy a property yourself, you can reap the same benefits by investing in a property investment fund. These types of funds are also known as REITs, or Real Estate Investment Trusts.

The information provided here is for informational and educational purposes only and does not constitute financial advice. Please consult with a licensed financial adviser or professional before making any financial decisions. Your financial situation is unique, and the information provided may not be suitable for your specific circumstances. We are not liable for any financial decisions or actions you take based on this information.

What different types of property investments are there?

As we covered briefly above, there are several different ways to invest in property in the UK. These are:

- REITs

- Buy-to-let

- Property developing

- Buying a new build to then sell on

- Investing in property abroad

We’ve explored each of these five types of property investments in more detail below.

1. Real Estate Investment Trusts (REITs)

Introduced in the UK in 2007, a REIT is a property investment firm listed on the stock exchange. The purpose of a REIT is to generate profit from its property portfolios and provide a return to its shareholders or investors for their investment.

This is done by pooling investors’ money and using it to invest in property that generates an income, which is then shared as dividends between the investors. REITs are exempt from corporation tax on profits generated from rental income and the income from the sale of rental properties, making them a tax-efficient choice.

2. Buy-to-let investments

A buy-to-let investment is when an investor purchases a property with the sole intention of renting it out with the aim of generating a rental return and income stream. It’s important to note that when you’re applying for a buy-to-let mortgage, most banks will require the expected monthly rental income to be 25% to 45% higher than your mortgage payment. You’ll also be expected to provide a higher deposit than a traditional mortgage, and you’ll have to pay a higher rate of stamp duty land tax.

3. Buying a new build to sell on

Buying a new build off plan can work out well when everything goes as planned, especially if the new neighbourhood is located in an in-demand area. It could, however, go wrong if the developer goes bust, the finished property isn’t what you expected or the area isn’t as desirable as you thought.

4. Investing in property abroad

If you want to purchase a cheaper property with better rental yields and a holiday home all in one, you might want to consider investing in property abroad. Many people choose between ‘sun’ or ‘ski’ destinations so they can rent the property out during the high season, and enjoy it themselves during the quieter months.

If you choose to go down this route, keep in mind that the property will need to generate enough income during the busy months to pay the mortgage on it (if you have one) throughout the year, as well as any applicable taxes. You’ll also need to maintain the property and might end up not being able to get there yourself.

5. Property development

Property development means purchasing a property, developing it either through renovation or refurbishment, and then either selling it for a higher price or renting it out to tenants for a monthly income stream. To make this work, you must be able to spot good development opportunities and be handy enough with DIY if you want to do the renovation work yourself.

How to invest in property

In order to actively pursue any of the above options, you might want to start by seeing a financial advisor who can advise you on how much you can realistically afford to invest, or set up a meeting with your bank to explore your mortgage options.

Before investing money in anything, it’s important to have around three to six months’ worth of earnings in an emergency fund, just in case of an unexpected financial shock.

How to invest in property when you don't have much money

You might be tempted to put your property investment dreams on hold due to a lack of funds or not knowing where to start.

However, there are things you can do to start your property investment journey and make your money work harder for you. Some of these are as follows:

- Take in a lodger: If you have the space, taking in a lodger is a great way to earn some extra income while also getting your first taste of what it’s like to be a landlord. Plus, the rent-a-room scheme allows you to earn up to £7,500 a year tax-free (£3,750 if you share the income with someone else).

- Invest in a REIT: If you have a lump sum that you can afford to invest – even a small one – a Real Estate Investment Trust is a great way to get into property investing without having to buy a property yourself.

- Look for property lease options: Because of the lack of benefit for homeowners, lease options are few and far between in today’s market. This arrangement is where you purchase an ‘option’ from a property owner which gives you the right to buy it at an agreed, fixed price during a set period of time. This ‘option’ can cost as little as £1, and you can choose to either exercise it or sell the option on.

- Joint venture: If you don’t have enough funds to buy a property alone, you could always choose to invest in a joint venture with a trusted friend or family member, and share both the burden and the profit. Keep in mind though that this person needs to be reliable and trustworthy.

- Buy ‘UMV’ and flip: Another form of property development, buying under market value (UMV) usually requires extensive research and attending auctions, or looking into off-market properties that have been repossessed. You’ll then need to be able to refurbish the property and sell it at a high enough cost to generate maximum profit.

The expenses of investing in property

Property is tangible, and therefore has more implications than other types of investments. Because of this, you’ll need to consider the expenses you’re going to face, and factor them into your investment planning. The expenses of property investing in the UK include the following:

- Mortgage fees

- Solicitors’ fees

- Estate agency fees

- Land registry fees

- Surveys

- Stamp duty

- Insurance policies

- Capital gains tax

The risks of investing in property

The biggest two risks of investing in property are that the housing market could crash, or that you could overstretch your finances and end up in financial difficulty.

While you can’t control the housing market, you can control your own finances and that’s why proper financial planning and sticking to your budget is essential.

To avoid financial difficulty or having your cash tied up in a house you’re struggling to sell, it might be better to diversify your investments portfolio. Find out more about investing in our comprehensive guide to investments.

If you decide that investing in property involves more risk than you feel comfortable with, you could look at alternative ways to grow your wealth (more on this below). Putting your money into a competitive fixed rate bond, for example, can be a good way to grow your finances without putting your capital risk.

Selling vs. renting property

Selling | |

|---|---|

Pros | Con |

No responsibilities or maintenance | You could struggle to sell the property |

A large amount of cash will be freed up | You’ll have to pay CGT and stamp duty each time you buy/sell |

You’ll have more to spend on your next home, which would be exempt from capital gains tax (CGT). | You may be selling off an asset set to grow in the future |

Allows for equity release |

|

Renting | |

Regular income stream | Unreliable tenants could mean damage to your property or failure to pay the rent |

You’ll be keeping a tangible asset that should increase in value over time | You’ll have legal obligations, responsibilities and property maintenance requirements as a landlord |

Your tenants will be paying off the mortgage for you | |

The hassle of renting can be outsourced to an agent |

What investing in property looks like

- Research stages: area, types of property, tenants, attractive locations

- Choose a property

- Make an offer

- Arrange a mortgage

- Conveyancing period

- Exchange contracts

- Sale complete!

- Make a profit on your property

Tips for investing in property

- Set clear goals – Before embarking on any property investment journey, it’s important to be clear about what you want to achieve. Are you looking to earn a steady stream of income? Or do you intend to sell the property as quickly as possible and pocket a lump sum? Whatever your goals, you should have a clear investment strategy in place to help you achieve them.

- Do your research – From transport links to schools and the local job market, research the area thoroughly before buying any type of property. Look at past purchase prices and local rental values. Are prices increasing or decreasing?

- Get to grips with the regulations – While it might not be the most exciting part of your venture, make sure you understand the rules and regulations around property investing and, if you’re going to rent your property out, your obligations as a landlord. And don’t forget to watch out for government tax changes; breaching the rules, even unintentionally, could prove a costly mistake.

- Have an exit strategy – Having an exit strategy is an important part of your plan. When do you intend to sell the property? Of course, the exact timing will depend on your individual circumstances and financial goals. For example, if you’re using the sale proceeds for a pension, you may want to wait until you approach retirement age. However, if your intention is to maximise profit, you might choose to sell when the property reaches a certain value.

- Buy for the lowest possible price – Property investing 101 is to always buy for the lowest possible price. This is easier said than done, particularly when you’re competing with buyers who intend to live in the property and may be prepared to pay more.

- Build a reliable network – Building a trusted and reliable network of contacts is important when you’re investing in property. From tradespeople to estate agents and property management companies, establishing good relationships with key professions can help to make your property investment journey that little bit smoother

- Review your investment strategy – As with any type of investing, it’s a good idea to review your strategy from time to time to check if it’s still the best option for you and your finances. Changing market conditions, rising mortgage rates and new government policies can all impact the housing market, so it’s important to remain vigilant if you want to maximise your return.