What is cryptocurrency, and how does it work?

So you’ve heard people talking about cryptocurrency and Bitcoin, but you’re not quite sure what they are? Whether you’re interested in investing, making secure transactions, or simply learning more, this guide covers everything you need to know. We’ll explain what cryptocurrency is, how it works, the different types of cryptocurrency, its advantages and disadvantages, and much more.

Key takeaways

Cryptocurrency is a type of digital money that uses encryption and blockchain technology to enable peer-to-peer transactions without needing banks

Cryptocurrency can be used for online purchases and investments, offering global transactions with low fees

In the UK, you can buy and store cryptocurrencies like Bitcoin and Ethereum in digital wallets, but investing in crypto comes with a high level of risk

What is cryptocurrency?

Cryptocurrency, also known as crypto, is a type of digital money that uses encryption for security and can be used for buying goods or services, investing, or trading to make a profit. Transactions are kept secure using complex codes in a process called cryptography.

What makes cryptocurrency different from traditional currency is that it doesn’t need banks to verify transactions. Instead, transactions are recorded on a blockchain, which is like a digital record book.

Cryptocurrency works through a peer-to-peer system, where users can send and receive payments directly to their digital wallets.

How does cryptocurrency work?

Here’s how cryptocurrency works: When someone wants to make a transaction like an online purchase using cryptocurrency, it’s verified by a network of computers using complex mathematical algorithms. Once verified, the transaction is recorded in a block, which is then added to a chain of previous transactions, forming what’s known as the blockchain.

The whole process is known as mining. It not only verifies transactions but also creates new units of the cryptocurrency. The blockchain, where all transactions are recorded, is publicly accessible and constantly updated to ensure transparency and security. This continuous synchronisation helps prevent the same cryptocurrency from being spent twice.

Bitcoin is one of the most popular examples of cryptocurrency. Its transactions are securely recorded on the blockchain, making it resistant to fraud and manipulation.

Why was cryptocurrency created?

Before Bitcoin emerged in 2009, there were various attempts at creating digital currencies, but none achieved widespread success like Bitcoin. Bitcoin was created by an individual or group operating under the pseudonym Satoshi Nakamoto. Nakamoto’s main goal was to revolutionise online transactions by enabling direct peer-to-peer exchanges without the need for traditional banks and financial institutions.

This all goes back to the fallout from the 2008 financial crisis. By decentralising currency, Nakamoto wanted to give people more control over their money. Nakamoto’s invention of Bitcoin sparked a global interest in cryptocurrencies, with many seeing them as opportunities for profit through trading.

Understanding key cryptocurrency terms and definitions

Cryptocurrency can be a complex field, with its own vocabulary. Here’s a brief glossary of some of the most important terms you might come across:

- Altcoin: Any cryptocurrency other than Bitcoin, including Ethereum, Ripple, and Litecoin.

- Exchange: An online platform where cryptocurrencies can be bought, sold, and traded. Exchanges facilitate transactions between buyers and sellers, which brings liquidity to the crypto market.

- Wallet: A digital tool used to store, send, and receive cryptocurrencies. Wallets come in various forms, including software, hardware, and paper wallets.

- Token: A digital asset created on a blockchain, representing ownership or access rights within a specific project or network. Tokens can be used for things like crowdfunding, voting, or accessing services within certain apps.

- Mining: The process of validating and adding transactions to a blockchain. Miners compete to solve complex mathematical puzzles, and the first to solve the puzzle receives a reward in the form of newly minted cryptocurrency.

How many cryptocurrencies are there?

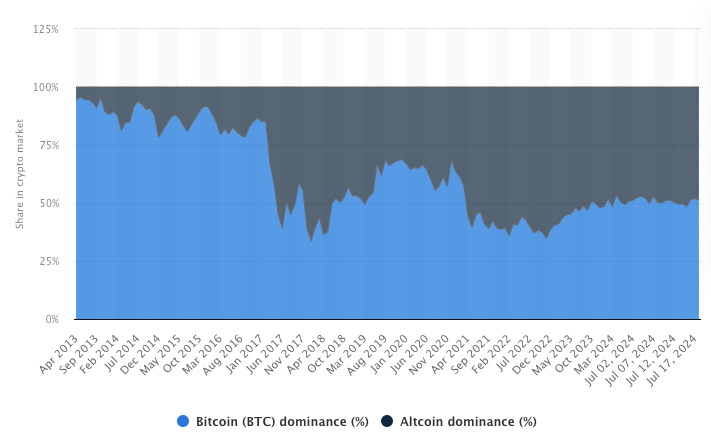

Cryptocurrencies have surged in popularity in recent years, with estimates suggesting there are around 20,000 in total. However, many of these are no longer in use or have lost their value. If you exclude these inactive cryptocurrencies, there are over 10,000 different cryptocurrencies worldwide as of January 2025, according to Statista.

Source: https://www.statista.com/statistics/1269669/bitcoin-dominance-historical-development/

Is cryptocurrency real money?

Cryptocurrency is real money, but it’s not physical like coins or notes. Instead, it exists virtually, recorded in online databases and public ledgers when transactions occur.

You might be wondering: what determines the value of cryptocurrency? It’s not like traditional money that’s backed by something like gold or controlled by a government. Instead, its value comes from the people willing to buy and sell it, and how much competition there is from other cryptocurrencies - in other words, it’s driven by supply and demand. So, while cryptocurrency can be used as money, its value can be volatile and unpredictable and change from one day to the next.

What is cryptocurrency used for?

You can use cryptocurrencies such as Bitcoin in many ways, including buying goods, services, and investment trading. People typically use cryptocurrency for shopping online, ranging from big purchases like property and travel to everyday items.

Cryptocurrencies are popular as you can carry out rapid, global transactions with minimal fees and without the need for intermediaries like banks. Because they’re not linked to a government or central authority, cryptocurrencies are generally accessible around the clock.

What is cryptocurrency trading?

Cryptocurrency trading is the process of predicting whether the prices of cryptocurrencies will go up or down, and then buying or selling them based on those predictions. People who trade cryptocurrencies usually do this through crypto exchanges. These exchanges work like marketplaces where traders keep an eye on prices and make their transactions.

Is cryptocurrency legal in the UK?

Yes, cryptocurrency is legal in the UK, although it’s not recognised as legal tender. The government regulates certain types of crypto assets, including exchange tokens. You can freely buy these assets from providers and store them in digital wallets without breaking any laws.

As of January 2021, all cryptocurrency firms operating in the UK market, including exchanges and advisers, must register with the Financial Conduct Authority (FCA), which is the UK’s financial regulatory authority.

According to the FCA, because of the lack of regulation, it’s unlikely that investors in crypto assets would have access to the Financial Services Compensation Scheme (FSCS), which protects deposits up to certain limits in case of a bank closure.

If you prefer this level of security, the Raisin UK marketplace offers various high-yield savings accounts with FSCS protection.

What types of cryptocurrencies are available in the UK?

In the UK, you can use various types of cryptocurrencies to invest or carry out transactions. These include both coins, which have their independent blockchains, and tokens, which trade on existing blockchains.

Some well-known examples of cryptocurrencies include:

- Bitcoin (BTC): The original and most popular cryptocurrency, with the largest market capitalisation. Bitcoin is often used as a digital alternative to traditional currencies.

- Ethereum (ETH): A blockchain platform with extra features. Ethereum allows for transactions and agreements to be executed automatically without the need for intermediaries, and uses its native currency, Ether.

- Litecoin (LTC): Created as the "silver to Bitcoin's gold", Litecoin offers faster transaction times and lower fees.

- Ripple (XRP): Designed for cross-border payments, the Ripple network offers speedy and low-cost international transactions.

These cryptocurrencies can be bought through various platforms and services, including dedicated cryptocurrency exchanges such as Coinbase and Kraken. You can also buy, sell, and store cryptocurrencies with payment services like PayPal and Revolut.

What are the advantages and disadvantages of cryptocurrency?

Advantages of cryptocurrency:

- Enhanced security: Cryptocurrencies use secure blockchain technology, making transactions safer and less prone to fraud.

- Global reach: Anyone with internet access can use cryptocurrencies.

- Transparency: Transactions are openly recorded on a public ledger, providing transparency and accountability.

- Lower transaction costs: Compared to traditional banking, cryptocurrency transactions usually come with lower fees.

Disadvantages of cryptocurrency:

- Price volatility: The value of cryptocurrency can fluctuate wildly, posing risks for investors.

- Lack of regulation: Cryptocurrencies are not regulated by governments or central banks, leaving investors with less protection.

- Technical hurdles: Understanding how cryptocurrencies work can be challenging for some people.

- Potential misuse: Because they’re anonymous, cryptocurrencies can be used for illegal activities, and scams are common.

Investment risks:

While cryptocurrencies can bring big profits, they also carry risks like price swings. Some early users have made a lot of money from cryptocurrency, but it’s important to know and consider these risks before you invest.

How do I buy cryptocurrency?

Here are some steps you can take to start investing in cryptocurrency:

- Choose where to buy: Start by selecting a broker or a crypto exchange. These are platforms where you can buy, sell, and trade cryptocurrencies like Bitcoin and Ethereum. Once you’ve chosen, you can create an account.

- Deposit cash: After your account is set up and verified, you’ll need to deposit cash into it. This can usually be done through methods like bank transfer, credit/debit card, or digital payment services like Apple Pay or Google Pay. Most crypto exchanges will allow you to buy cryptocurrencies using your standard currency, such as GBP.

- Place your order: With cash in your account, you can now place an order to buy cryptocurrency. To do this, you specify the amount of cryptocurrency you want to buy and at what price.

- Decide on storage: Once you’ve bought your cryptocurrency, you’ll need a safe place to store it. Some people choose to keep their cryptocurrency on the exchange platform, while others prefer to transfer it to a personal digital wallet for added security.

The information provided here is for informational and educational purposes only and does not constitute financial advice. Please consult with a licensed financial adviser or professional before making any financial decisions. Your financial situation is unique, and the information provided may not be suitable for your specific circumstances. We are not liable for any financial decisions or actions you take based on this information.

Is cryptocurrency safe?

Cryptocurrencies like Bitcoin and Ethereum rely on blockchain technology, which offers robust security features. Transactions are encrypted and stored in a unique code with a timestamp, making it difficult for cybercriminals to tamper with.

However, investing in cryptocurrency involves risks, much like any other investment. Volatility in the crypto market, cybersecurity threats, and potential scams are some things you might consider. Cryptocurrencies are not issued or regulated by any central government authority in the UK, which adds to the risk that comes with this kind of investment.

To lower risks when investing in crypto, it’s important to consider precautions to protect your digital assets. There are steps you can take, such as using secure platforms and wallets, being wary of scams, and investing only what you can afford to lose. Remember that cryptocurrencies are highly speculative and unpredictable, so thorough research and choosing trusted platforms can help minimise the risk of loss. Also, it’s worth noting that if your cryptocurrencies are lost or stolen, there’s no protection or insurance, so you could potentially lose all your investment.

Building your savings with Raisin UK

While stocks are seen as a less risky investment than cryptocurrencies, investing is never entirely risk-free, and returns may take years to materialise. If you prefer the security of guaranteed competitive interest rates where you can calculate exactly how much you’ll earn, consider a fixed rate bond. Register for a free Raisin UK Account today to access a wide range of savings accounts.