What is a digital wallet, and how does it work?

In today’s fast-paced digital world, managing your money has never been easier, thanks to digital wallets. A digital wallet is an electronic device or online service that allows you to make payments securely and conveniently, store important documents, and more. On this page, we’ll look at what digital wallets are, how they work, their security, and how you can benefit.

Key takeaways

A wallet app securely stores payment information, allowing you to pay for items, and store tickets and other documents

Using technologies like NFC and QR codes, digital wallets allow seamless payments online and through smartphones, tablets, or smartwatches

Digital wallets offer robust security measures like encryption and biometric login options, so you can pay safely

The information provided here is for informational and educational purposes only and does not constitute financial advice. Please consult with a licensed financial adviser or professional before making any financial decisions. Your financial situation is unique, and the information provided may not be suitable for your specific circumstances. We are not liable for any financial decisions or actions you take based on this information.

What is a digital wallet?

A digital wallet, sometimes referred to as an e-wallet or electronic wallet, is essentially a virtual version of a physical wallet. It stores passwords and payment information, such as credit and debit card details, as well as loyalty cards, boarding passes, tickets, and even cryptocurrencies, all within a secure digital environment like the cloud. This means you can manage many situations without having to carry around a bulky purse or wallet stuffed with cards and cash.

Digital wallets come in various forms. Mobile wallets tend to be the most common type, as you can access them via a mobile wallet app on your phone. With a few taps on your smartphone or other device, you can pay for items or services online, in-store, or through apps, without the need to rummage through your wallet. For payments in a shop, you have the option to deposit money into the wallet itself beforehand or link it directly to your bank account. With online wallets, you can pay for goods without having to input your card details repeatedly.

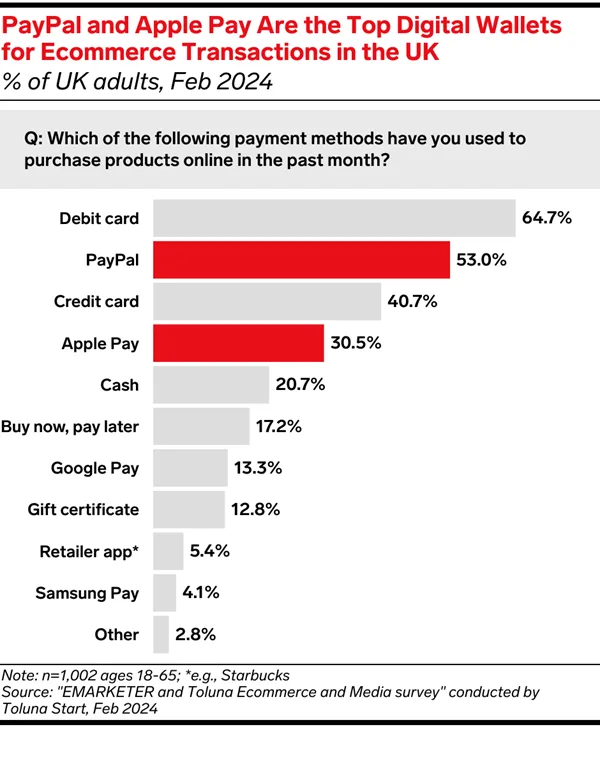

In the UK, digital wallets are becoming increasingly popular, and you might have noticed the contactless symbol appearing in many shops. When it comes to online shopping, digital wallets are projected to account for a significant portion of e-commerce transactions in the coming years, reaching an estimated £203.5 billion by 2027. For many people, it’s become an easy and efficient way to pay and manage their money.

What is the difference between a digital wallet and a mobile wallet?

Mobile wallets are a type of digital wallet. While they might seem similar, there are occasions when you would use one over the other. Digital wallets are mainly for online transactions, like when you buy something on a website. Mobile wallets, on the other hand, are for when you’re out and about and need to pay using your phone. Both let you connect to your bank accounts and cards to make buying easier.

You could think of a digital wallet as a virtual copy of your regular wallet or purse - it stores your card information for online shopping. A mobile wallet is specifically for your phone, letting you store payment details and make purchases through a special app.

What technologies do digital wallets use?

When defining digital wallets, it can help to understand the technology involved, as this will determine how you use the wallet.

The most common digital wallet technologies include:

- NFC (Near Field Communication): NFC technology allows devices to communicate wirelessly when they are close to each other. This is what allows you to make contactless payments effortlessly by simply tapping your device on a payment terminal.

- QR codes: QR codes are scannable codes that contain encrypted payment information. Some digital wallets use QR codes for making payments, where the merchant scans the code to process the transaction.

- Mobile apps: Most digital wallets are accessed through mobile apps. Mobile apps are widely used for both in-store and online payment.

While mobile banking is already a popular choice for managing finances, the Raisin App takes it a step further. You can conveniently apply for savings accounts with our partner banks and building societies, compare competitive interest rates, and manage your savings on the go.

What are the three types of digital wallets?

- Closed wallet: A closed e-wallet is an online payment method where you can store funds and spend them only with the issuer of the wallet. It’s commonly used by large businesses, like Amazon Pay, for payments, returns, and refunds. Closed wallets are integrated into companies’ systems and are ideal for global transactions.

- Semi-closed wallet: A semi-closed digital wallet lets you make transactions at specific merchants and locations. While it has limited coverage, you can use it for both online and offline payments. Merchants must agree to accept payments from this type of wallet.

- Open wallet: Issued by banks or their partners, open wallets offer the same functionality as semi-closed wallets. You can also withdraw cash from banks and ATMs, transfer funds, and other services like online banking and card swiping for payments while shopping.

There is another type of digital wallet for cryptocurrencies, known as the crypto wallet. This is an e-wallet that you can use to buy, store, send, and receive cryptocurrencies like Bitcoin. Crypto wallets typically come in the form of online platforms that store your keys.

What else can a digital wallet be used for?

A digital wallet isn’t just for storing credit and debit cards; it can be used as a way to organise various documents and information, and declutter your physical wallet in the process. You can use a digital wallet to store boarding passes, gift cards, tickets, and coupons, so you have what you need when you need it.

Digital wallets offer a range of other services depending on the provider. For example, with Google Pay, you can store plane tickets and receive real-time updates on flight delays. You can also keep track of vaccination records, loyalty cards, driving licences, insurance cards, and other important ID documents.

Examples of digital wallets

When it comes to digital wallets, there are four major players that dominate the market:

- Google Pay: Pre-installed on most Android phones, Google Pay allows you to make payments, store loyalty cards, and send cash to friends.

- Samsung Pay: Exclusively available on Samsung devices, this digital wallet supports both NFC and Samsung-specific MST technologies.

- Apple Wallet: Found on all Apple devices, Apple Wallet stores your payment cards, boarding passes, tickets, and more. It works seamlessly with other Apple services.

- PayPal: PayPal is a service that lets you make online payments, money transfers, and in-store purchases.

Typically, the digital wallet you use is determined by your phone’s operating system. For example, you can’t use Apple Wallet on a Google smartphone. However, PayPal is an exception, as it’s compatible with various devices, regardless of their model.

What are the advantages and disadvantages of digital wallets?

Advantages of digital wallets:

- Convenience: Digital wallets let you make payments quickly and easily, whether online or in-store.

- Security: With robust encryption and authentication measures, digital wallets offer a secure way to carry out financial transactions, reducing the risk of fraud or theft.

- Transaction tracking: Digital wallets provide detailed transaction histories, so you can monitor your spending habits.

Disadvantages of digital wallets:

- Technological dependency: Relying on devices and digital services means you are always vulnerable to technical glitches, drained batteries, or system failures, which could leave you without access to your money when you need it most.

- Privacy concerns: Sharing your financial information with digital platforms raises privacy concerns. Data breaches or unauthorised access could put your sensitive information at risk.

- Availability: Although digital wallets are widely used nowadays, you cannot always guarantee a certain shop will offer contactless payments.

Are digital wallets safe?

Digital wallets offer robust security measures to protect your financial transactions. Each payment you make is tokenised, a process that encrypts your credit or debit card details to keep them hidden from retailers.

What’s more, digital wallets feature various security features like two-step verification, encrypted payment codes, and biometric login options such as fingerprint or face recognition. These measures add extra layers of protection to prevent unauthorised access to your e-wallet.

While mobile devices typically offer better protection against malicious software than desktops, it can be a good idea to take precautions when using digital wallets for transactions. Just as you would with your bank card, you can stay safe by securely storing your phone in a bag or pocket and ensuring any sensitive information is covered as you pay.

If you’re interested in learning more about staying safe in this digital banking age, we have a series of helpful online safety articles.

Digitising your banking with Raisin UK

With Raisin UK, you can easily check your savings balance wherever you are, and manage multiple accounts in one place, right from your mobile phone or laptop. Register for a Raisin UK Account today, and take advantage of competitive interest rates.